Things to consider when using engulfing patterns

False signals

Engulfing patterns can sometimes produce false signals. After all, technical analysis does not guarantee results — it only produces signals that you should further confirm. False signals can cause incorrect trading decisions, especially if you don’t confirm them with other technical indicators or market context.

Subjectivity

Traders may have varying criteria for identifying and validating the engulfing patterns, which means that pattern interpretation can be subjective. This subjectivity means that the signals are not always as universal as we would like them to be.

Lack of context

Engulfing patterns should be considered within the broader market context, as isolated patterns may not always lead to significant price reversals. If you only see an engulfing candlestick pattern, you should not always expect an impressive price movement if no news or decisions may impact the asset in the near future.

Overlapping candles

Engulfing patterns may occur due to overlapping candles or noise in the price chart in some cases. This makes it a real challenge to distinguish valid signals.

Market volatility

When the market is very volatile, false signals are more likely. Volatility reduces the reliability of engulfing patterns as a standalone trading strategy. It means that you should double-check the signals with other indicators or market context.

Risk management

Engulfing patterns alone may not provide sufficient information for effective risk management. You should always use additional tools for extra protection. For example, stop-loss orders and position sizing should always be used when you open your positions.

Timeframe dependence

Engulfing patterns may be more effective for some timeframes and less effective for others. Use the timeframe that best suits your trading style and analyze the chart accordingly.

Confirmation bias

Confirmation bias happens when you search for information that confirms your existing beliefs or decisions. When some info contradicts your opinion, you ignore it. If you rely on engulfing patterns without considering other tools or fundamental factors, you may easily find yourself in a confirmation bias.

Historical performance

If engulfing patterns worked well for you in the past, it does not guarantee future success. The reason is simple: market conditions and dynamics can change over time. Markets exist in the real world, and the real world may change rapidly. You should always consider current market conditions and the situation before you make your trading decision.

Limited predictive power

Engulfing patterns are one of many candlestick patterns. They should be used together with other technical indicators to increase prediction accuracy.

FAQ

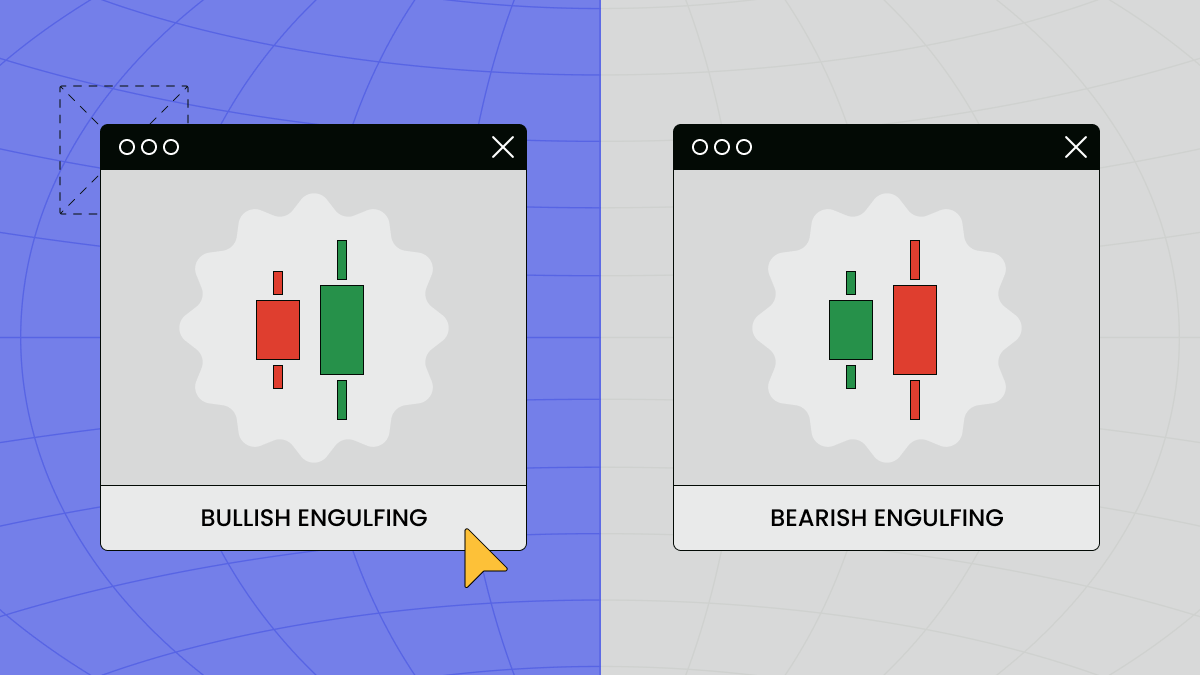

What is a big bearish engulfing pattern?

It is a pattern where a large bullish candle is followed by a larger bearish candle. The second candle fully covers the high and low of the previous candle. This pattern indicates a potential reversal from bullish to bearish momentum.

How strong is a bullish engulfing signal?

Bullish engulfing patterns show a bullish reversal is highly likely, especially when they happen at important support levels or after a prolonged downtrend. However, traders should always consider other technical indicators for confirmation.

Is bullish engulfing a buy or sell signal?

As the name suggests, it is a bullish pattern. This pattern represents a buy signal that indicates the potential for a bullish reversal. You may view it as a situation where buyers have overwhelmed sellers, so you face an opportunity to enter a long position.