The AUDUSD pair slightly declined after hitting a new yearly high of 0.6900 during Wednesday’s US session. However, the overall outlook remains positive due to the Reserve Bank of Australia (RBA) indicating that interest rates will stay steady through the year-end. The Australian Dollar is also benefiting from China’s recent stimulus measures aimed at boosting household spending and the real estate market. Meanwhile, the US Dollar has weakened, with the Dollar Index (DXY) dropping to 100.20, its lowest level in over a year, as markets expect the Federal Reserve to cut rates again in November. If AUD/USD breaks above 0.6910, it could push towards the next target of 0.7000.

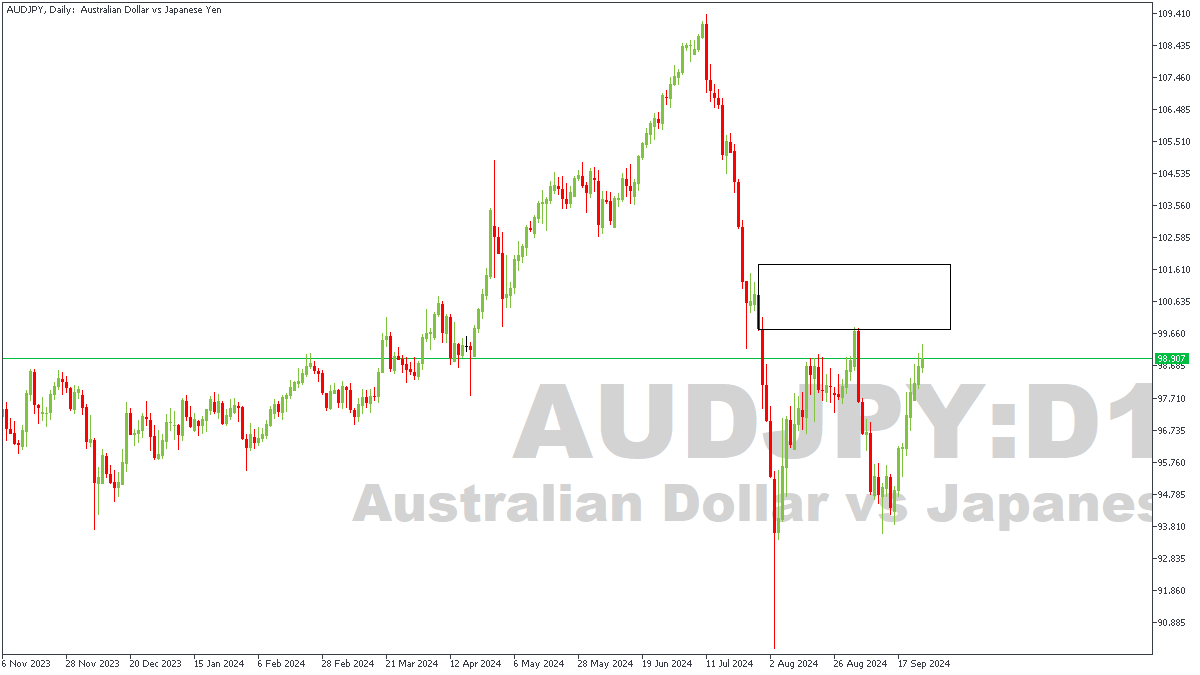

AUDJPY – D1 Timeframe

The Daily timeframe of AUDJPY shows price currently retracing into the supply zone, after undergoing a major rejection at the supply zone initially. From the daily timeframe, the short high before the rejection serves as a shoulder for a possible head-and-shoulder pattern; or a SBR pattern, if you will.

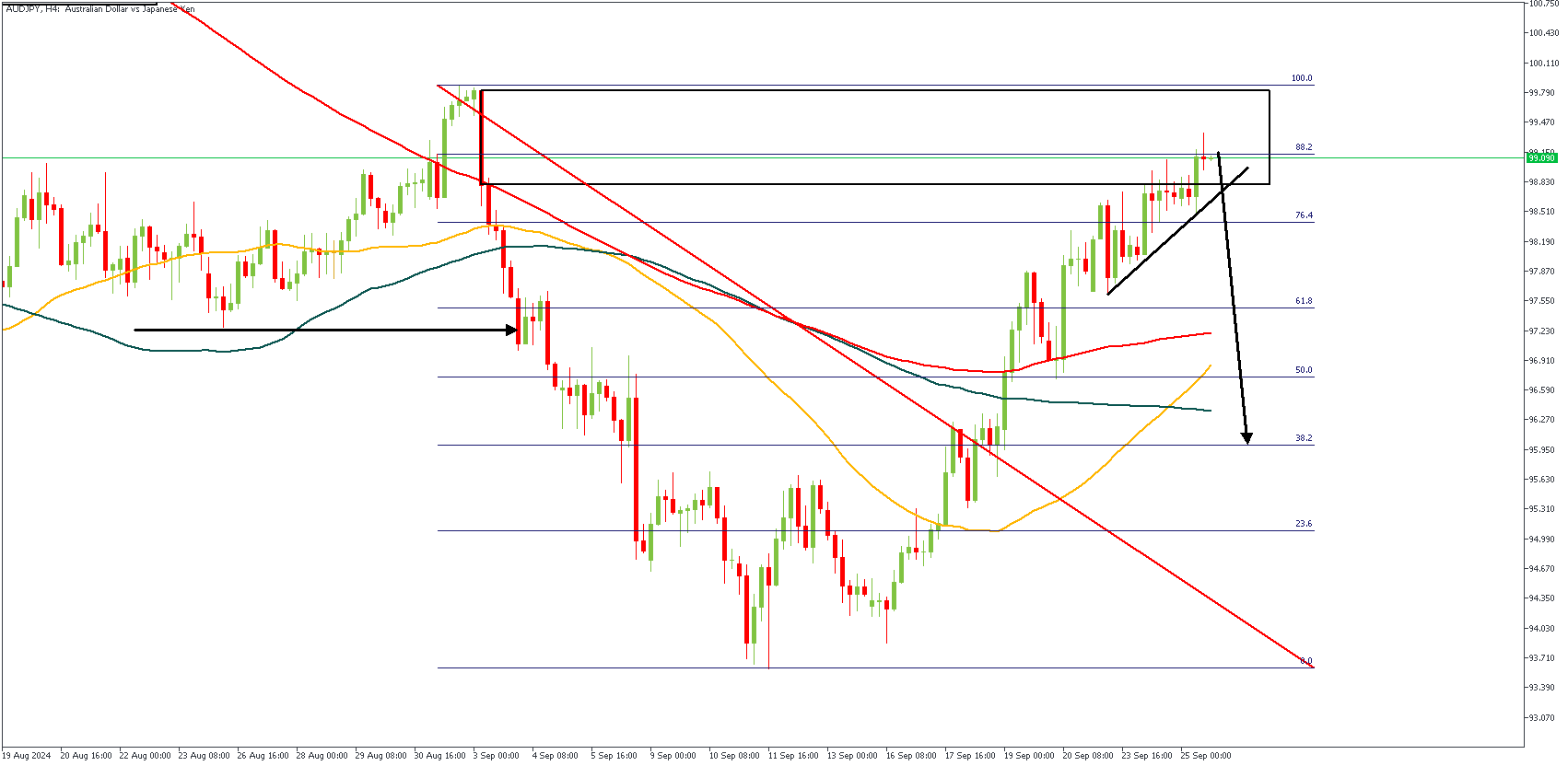

AUDJPY – H4 Timeframe

On the 4-hours timeframe of AUDJPY, we can see price currently trading above a trendline support whilst within the supply zone. The break below the trendline support will provide the necessary confirmation of the bearish sentiment since the 88% of the Fibonacci retracement is also within the current vicinity of the price action, serving as confluence for entry.

Analyst’s Expectations:

Direction: Bearish

Target: 95.950

Invalidation: 99.970

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.