The European Union (EU) and China are continuing discussions to find an alternative solution to replace the new tariffs imposed on Chinese-made electric vehicles (EVs). So far, no agreement has been reached, but progress is being made, according to a spokesperson from China’s Ministry of Commerce. Both sides are working on a proposal to set a minimum price for Chinese EVs in the EU, addressing concerns about unfair competition due to subsidies.

Earlier this week, Bernd Lange, head of the EU trade committee, mentioned that a deal might be close, as this price floor could prevent market distortions and eliminate the need for high tariffs. However, the EU rejected a similar proposal in September, saying it couldn’t be adequately enforced.

The current tariffs on Chinese EVs, which began in October, range from 7.8% to 45.3%, depending on the brand. In response, China has introduced tariffs on European goods like brandy and gasoline-powered cars. These trade tensions have hurt stocks in both regions, with major European automakers and beverage companies seeing significant share price drops.

Amid these tensions, the EU and China are also dealing with challenges from US tariff policies and economic headwinds in their domestic markets, adding pressure to find a resolution.

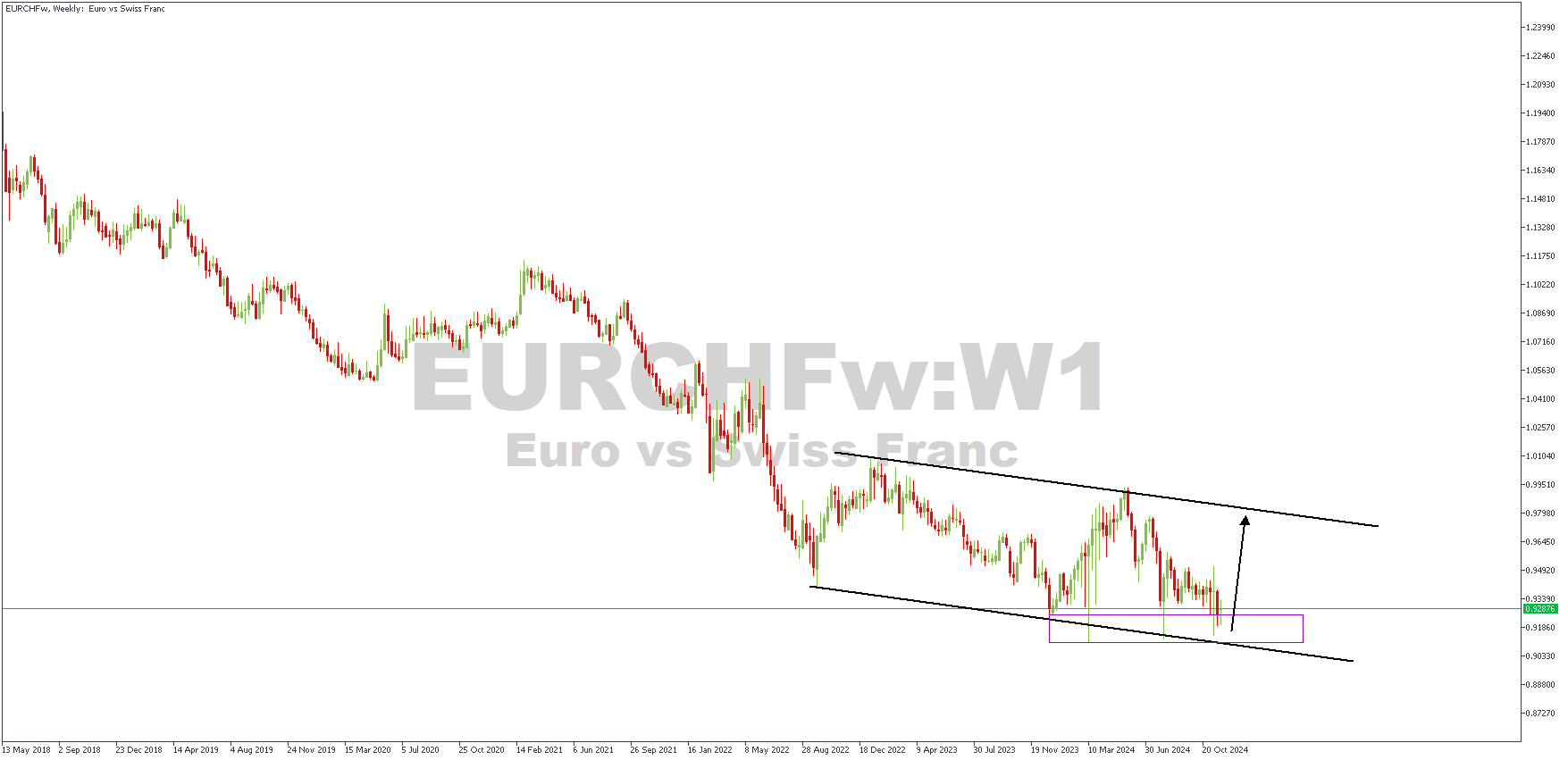

EURCHF – W1 Timeframe

EURCHF, on the weekly timeframe, is trading within the descending channel, with a retest of the trendline support and the demand zone. The 4-hour timeframe, however, will lend more detail to this sentiment.

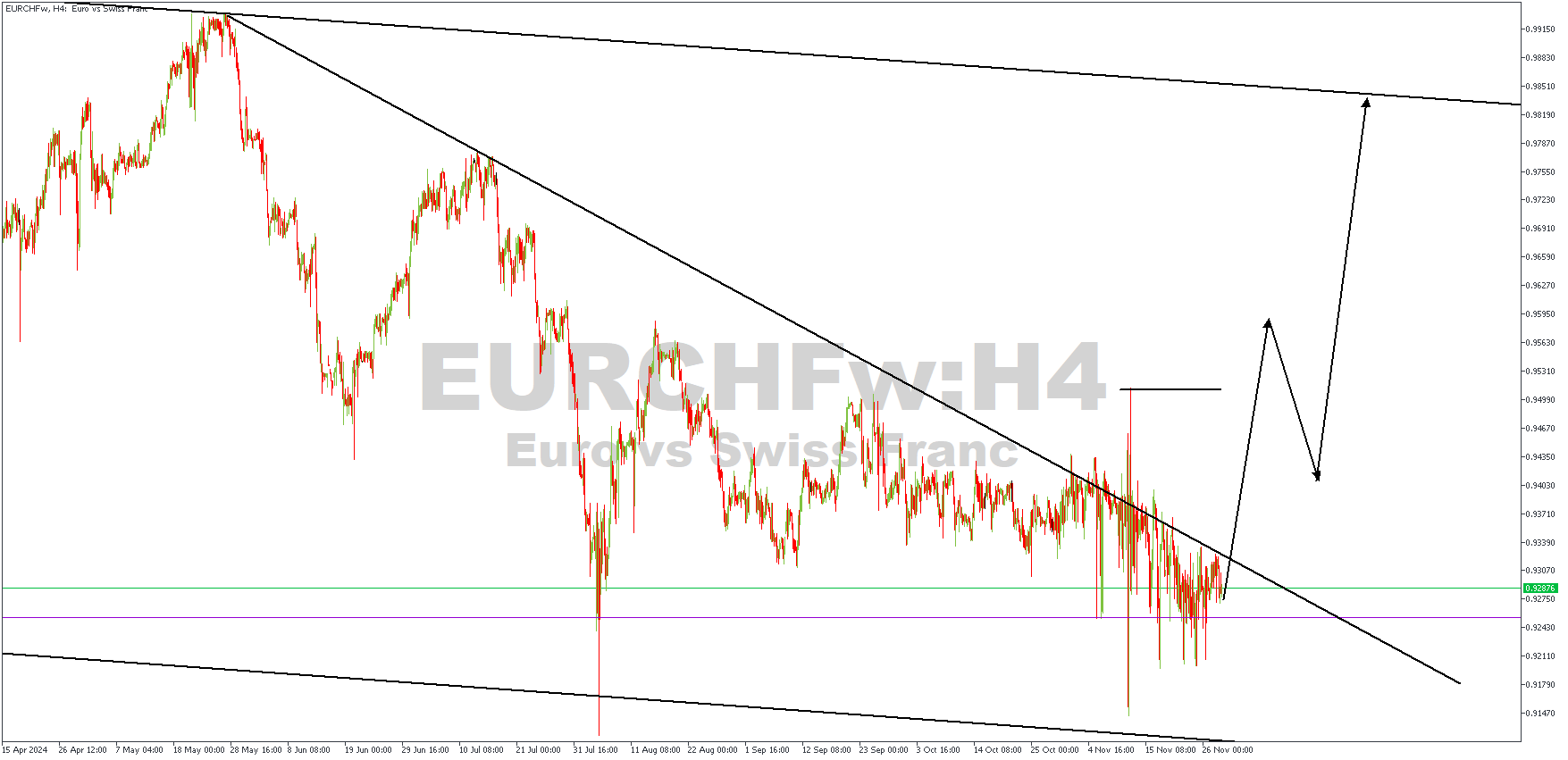

H4 Timeframe

The 4-hour timeframe chart of EURCHF shows the price recently breaking above the trendline resistance before returning to retest it. A safer approach to this would be to wait for a break above the highlighted high; otherwise, any entry prior to that would be considered an aggressive risk.

Analyst’s Expectations:

Direction: Bullish

Target: 0.97930

Invalidation: 0.90783

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.