The EURUSD pair is showing signs of buyer interest. The Relative Strength Index (RSI) climbed to 60, and the last three 4-hour candles closed above the 200-period Simple Moving Average (SMA). This suggests that buyers are gaining strength.

If the pair continues to rise, it might face strong resistance around 1.0390-1.0400, where the 100-period SMA and a key Fibonacci level are located. If it breaks through this area, the following targets could be 1.0440 and 1.0500-1.0510. On the downside, support could be found around 1.0290-1.0300, followed by 1.0250 and 1.0200.

The US Dollar struggled to find demand on Tuesday due to a slightly better market mood and a lack of significant economic data. Federal Reserve Chair Jerome Powell spoke to the Senate Banking Committee, saying there’s no rush to change monetary policy. Powell noted that inflation is closer to the 2% target but still a bit high.

Later today, the US will release the Consumer Price Index (CPI) for January. If the core CPI, which excludes food and energy prices, rises more than expected, it could boost the US Dollar and push EURUSD lower. Conversely, if inflation is lower than predicted, EURUSD will continue upward.

EURNZD – H4 Timeframe

.png)

From the supply zone on the daily timeframe chart of EURNZD, the 4-hour price action has created an SBR pattern with price seeking a retest of the supply zone. Once the liquidity from the equal high wicks gets swept, there should be occasion for a bearish entry.

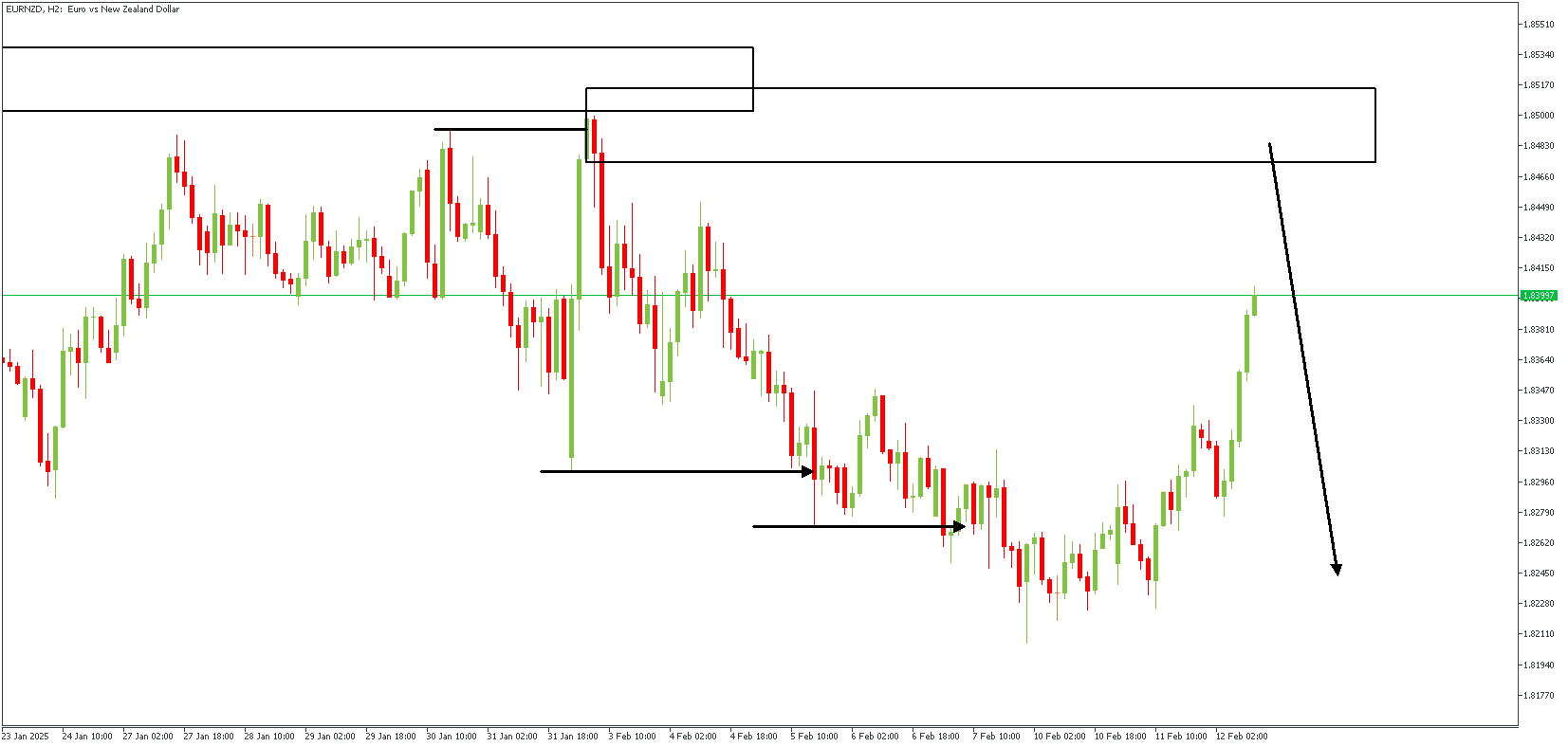

EURNZD – H2 Timeframe

The 2-hour timeframe chart of EURNZD shows the SBR pattern much better, with the FVG (Fair Value Gap) and liquidity levels being much more apparent. This note concludes that the price would get rejected off the supply zone on the 2-hour chart, as highlighted above.

Analyst’s Expectations:

Direction: Bearish

Target: 1.82535

Invalidation: 1.85435

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.