EURUSD continues to trade within a tight range above 1.0400 during the US session on Thursday, with a slightly positive outlook but limited upward momentum. US data showed that weekly jobless claims rose to 223,000, slightly higher than expected, which kept the US Dollar from gaining too much strength and supported EURUSD. Meanwhile, US stock markets showed mixed performances, with investors cautious ahead of President Trump's speech at the World Economic Forum in Davos. If Trump's comments increase demand for safe-haven assets, EURUSD could struggle to advance. On Friday, critical economic data, including manufacturing and services activity from Germany, the Eurozone, and the US, could influence the pair's direction.

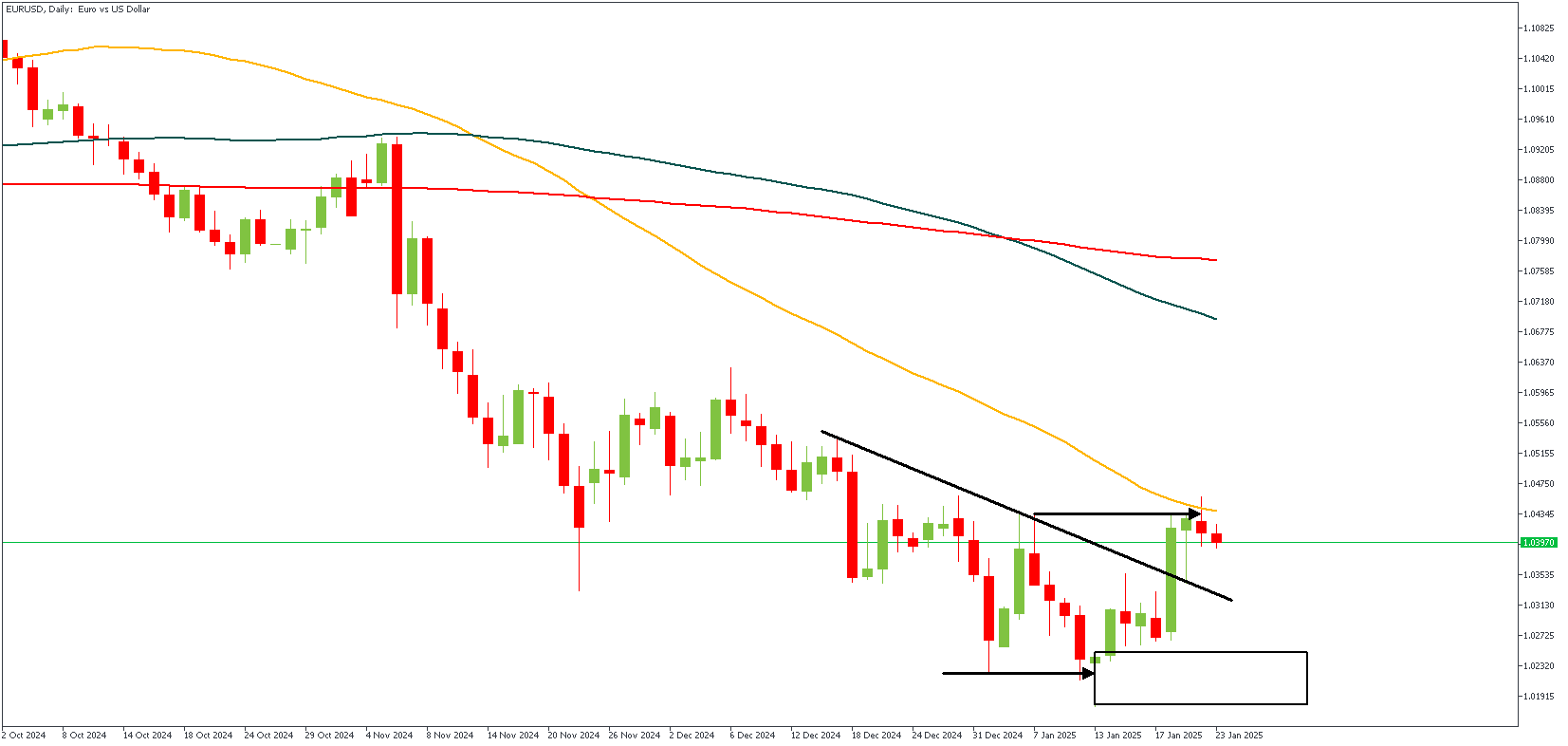

EURUSD – D1 Timeframe

After breaking above the trendline resistance on the daily timeframe chart of EURUSD, we see the exchange rate react off the 50-day moving average resistance as it slides back towards the drop-base-rally demand zone just below the trendline support.

EURUSD – H4 Timeframe

.png)

On the 4-hour timeframe chart, however, we see an internal trendline support overlapping the micro-structure demand zone near the golden ratio (61.8%) of the Fibonacci retracement tool. It would be interesting to see how the price reacts from the confluence of the two support trendlines, the 61% Fibonacci retracement level, and the micro-structure demand zone.

Analyst's Expectations:

Direction: Bullish

Target: 1.04597

Invalidation: 1.02303

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.