Fundamental Analysis

The Nasdaq 100 remains strong, reaching new all-time highs this Thursday, driven by gains in major tech stocks such as Tesla (+4%), Nvidia, Apple, and Microsoft. Optimism is focused on the anticipated pro-growth policies from the incoming U.S. administration, which reinforce expectations of improved corporate earnings. Additionally, the Federal Reserve's cautious stance on future rate cuts maintains a favourable environment for risk assets.

Technical Analysis

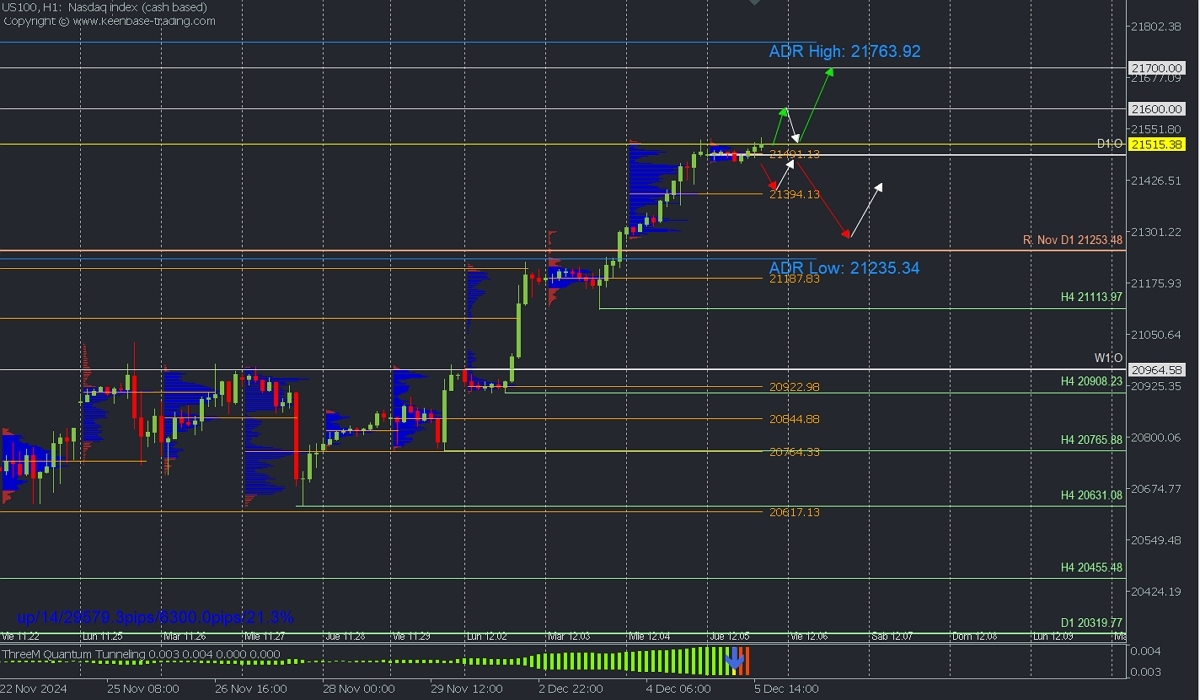

US100, H2

Supply Zones (Selling): 21600 and 21700

Demand Zones (Buying): 21491.13, 21394.13, and 21187.83

The Nasdaq 100 decisively broke November’s resistance at 21253.48, setting a new record high between yesterday and today at 21528. This level could extend toward the psychological references at 21600 and 21700 if prices stay above the volume concentration around the daily open at 21491.13. A drop below 21470, however, could trigger a correction to the intraday demand zone at 21394.13, which bulls will defend to sustain the rally. A decisive break below this demand zone would prompt a broader correction targeting November’s resistance at 21253.48 and the uncovered POC at 21187.83.

The last validated intraday support is 21113.97, suggesting that the uptrend remains intact unless this level is breached.

Technical Summary

Bullish Scenario: Buy on pullbacks at 21455 or 21400 with targets at 21600 and 21700 intraday. Use a 1% risk Stop Loss with a low lot size to allow for market fluctuations.

Bearish Scenario: Look for extended sell-offs if the price decisively breaks below 21394, targeting 21254, from which to resume buying.

Always wait for the formation and confirmation of an Exhaustion/Reversal Pattern (ERP) on M5 as demonstrated here https://t.me/spanishfbs/2258 before entering trades at the indicated key zones.

Uncovered POC Explanation:

POC = Point of Control: The level where the highest volume concentration occurred. If a downward move originated from it, it acts as a resistance zone. Conversely, if an upward impulse followed, it serves as a support zone, often located near lows.