Oil prices rose for the third consecutive session on Thursday, driven by easing demand concerns from better-than-expected U.S. job data and escalating tensions in the Middle East. Brent crude increased by 0.73% to $78.90 per barrel, while U.S. West Texas Intermediate climbed 1.16% to $76.10. The market was also influenced by a significant drop in U.S. crude inventories and concerns over potential disruptions in oil supply due to geopolitical tensions. Analysts noted the possibility of Brent prices rebounding to the low-to-mid $80s, citing tight market conditions and ongoing risks. Additionally, Libya's reduced oil production due to protests further supported prices.

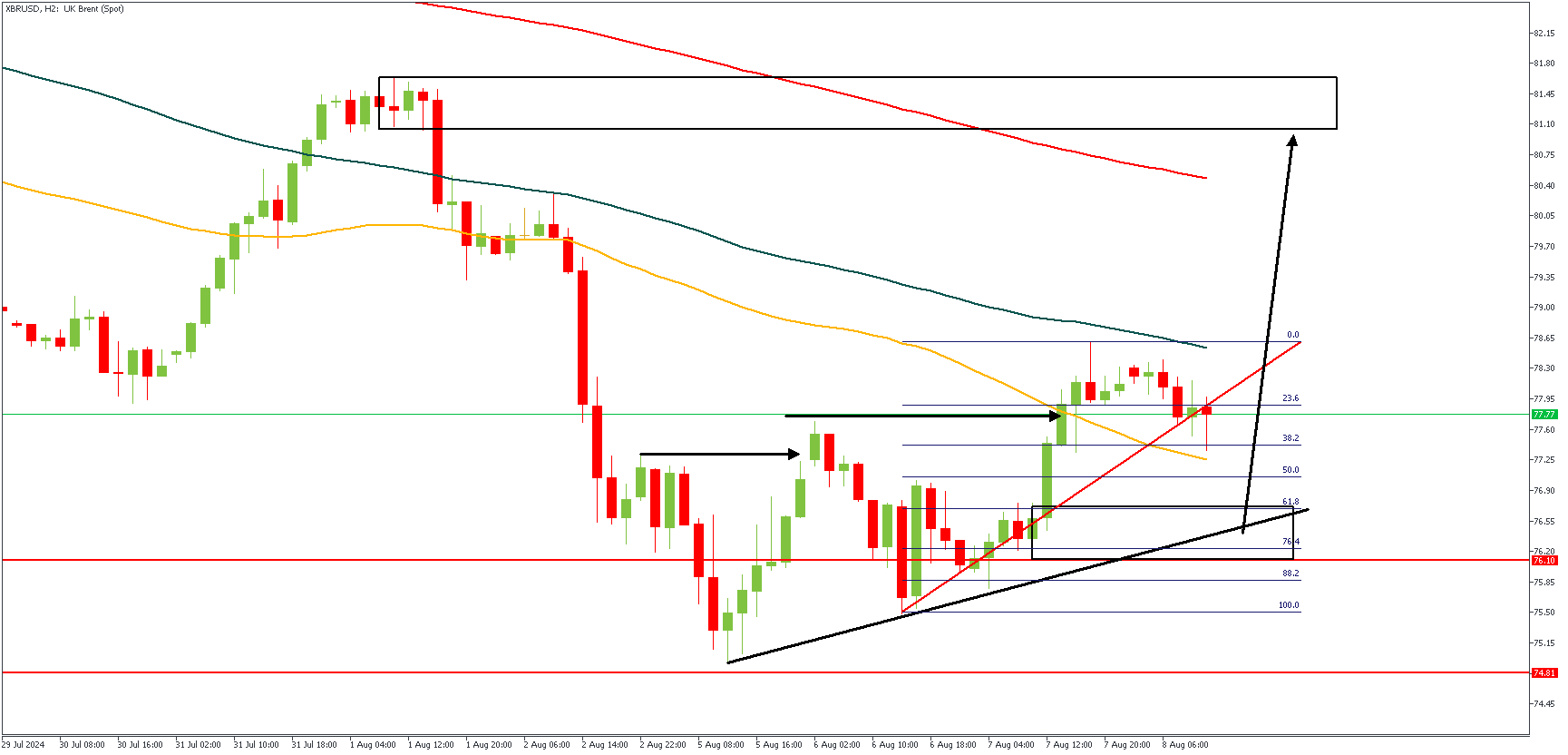

XBRUSD – H2 Timeframe

XBRUSD has recently been rejected off the daily timeframe pivot, with a ‘double break of structure’ price action pattern, a possible bullish sentiment. The trendline support, Fibonacci retracement level, and the drop-base-drop demand zone all point in favor of a bullish outcome. The lower timeframes would, however, provide the basis for an entry in this regard.

Analyst’s Expectations:

Direction: Bullish

Target: 81.00

Invalidation: 75.40

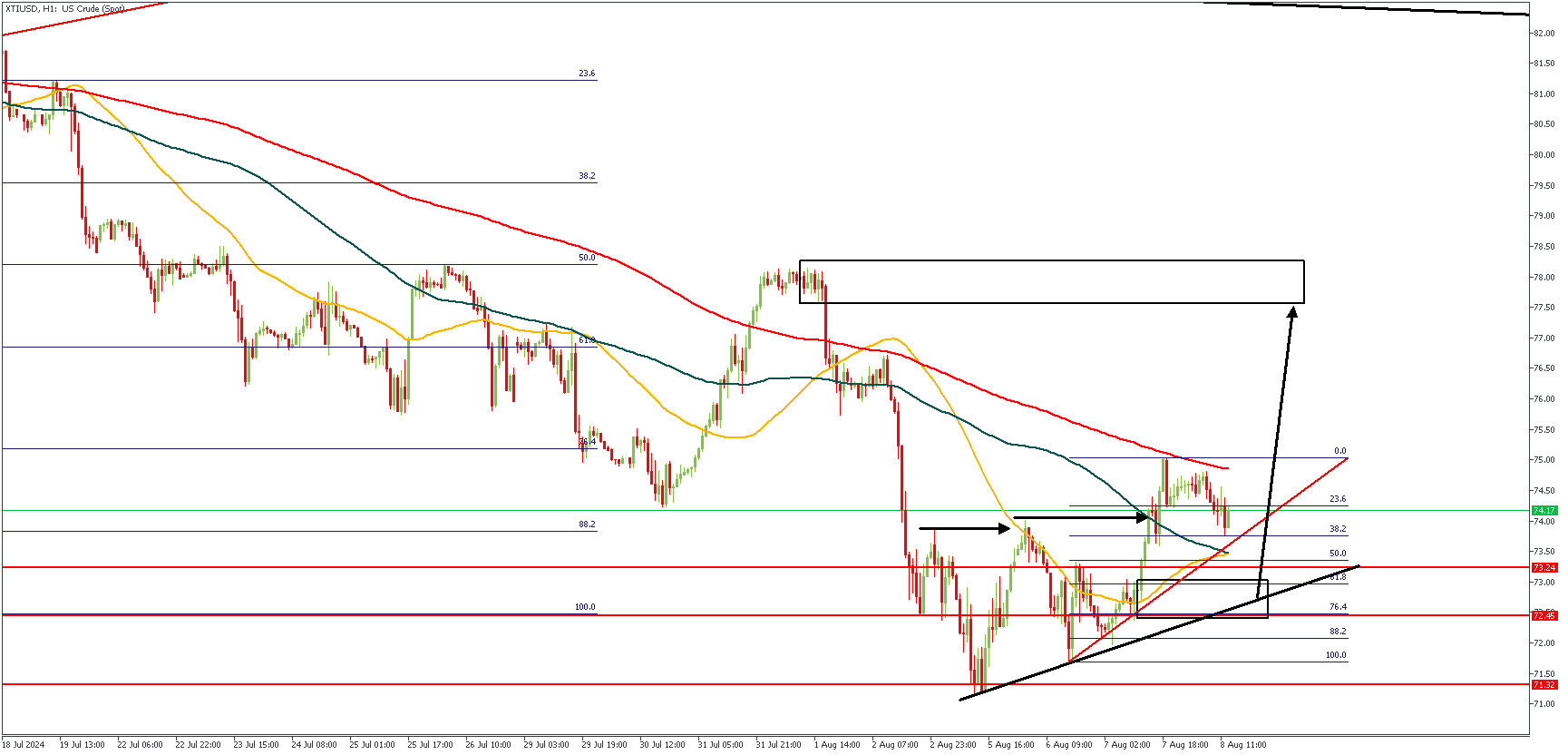

XTIUSD – H1 Timeframe

The 1-hour timeframe chart of the price action on XTIUSD closely mirrors the price action pattern on XBRUSD above; we have the same double-break of structure pattern, the drop-base-rally demand zone, the trendline support, and finally, the 76% of the Fibonacci retracement tool. The sentiment in this regard, is exactly the same: bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 77.00

Invalidation: 71.32

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.