Crude oil futures dropped slightly by 0.11% to Rs 6,346 per barrel due to reduced demand, as traders adjusted their positions. On the global front, West Texas Intermediate (WTI) crude oil remained stable at $75.53 per barrel, while Brent crude saw a minor increase of 0.14% to $79.44 per barrel in New York. Overall, the market is experiencing minimal fluctuations amid cautious trading.

XBRUSD – D1 Timeframe

.png)

Brent Oil on the 4-hour timeframe is currently playing out exactly as analyzed over the past couple of weeks; the bearish move began from the 76% retest of the Fibonacci retracement tool, the trendline resistance, and the moving average resistance from the 200-period moving average. I do not think the bearish momentum is ready to wane just yet, as I would expect price to take out the recent low to create a lower low.

Analyst’s Expectations:

Direction: Bearish

Target: 75.90

Invalidation: 82.80

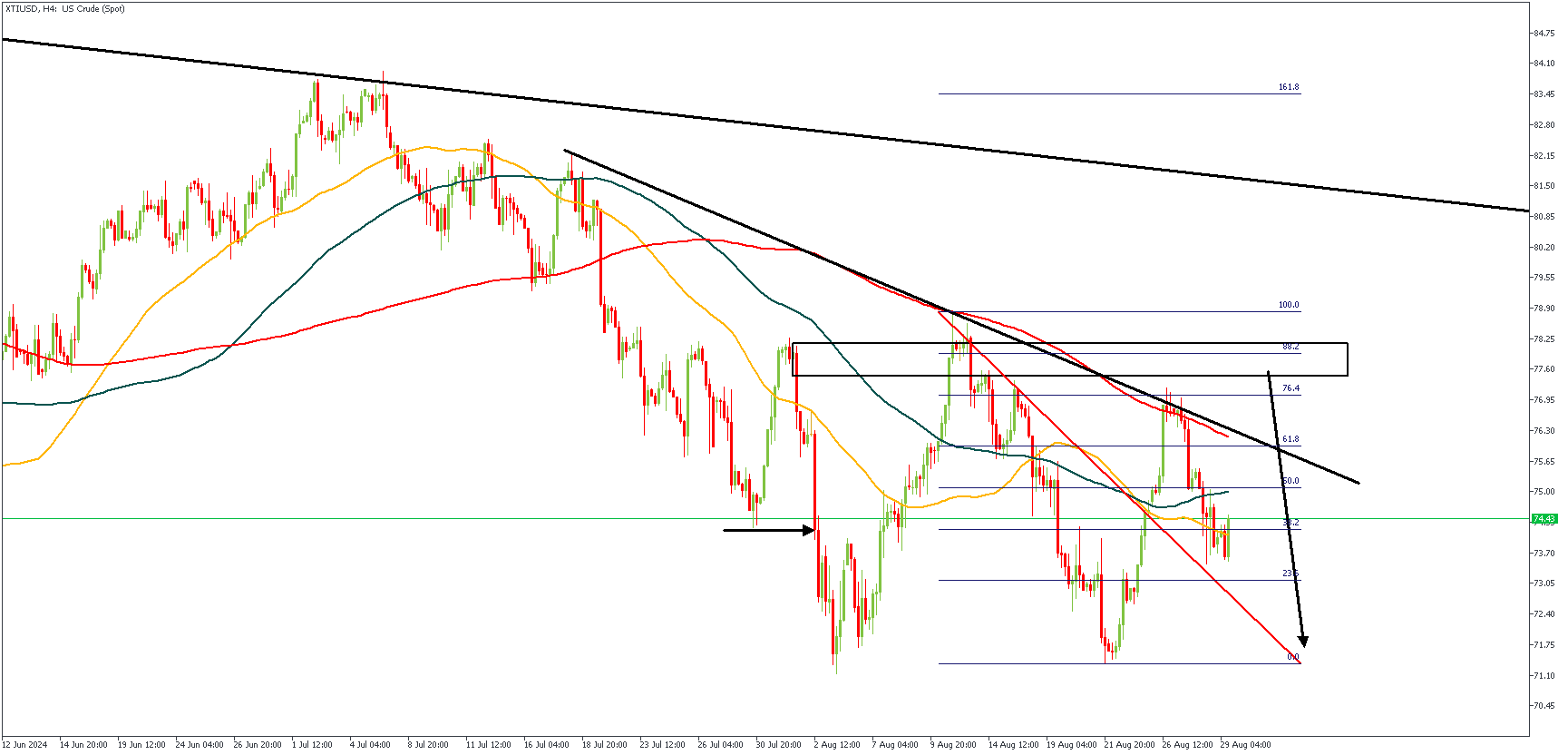

XTIUSD – D1 Timeframe

The price action on West Texas Intermediate (WTI) perfectly mirrors all the details from our analysis of XBRUSD above. In the same manner, I would expect price to create a new lower low; as is customary in a downtrend. It would be unwise to seek buying opportunities just yet, at least, not until price confirms a change in the trend.

Analyst’s Expectations:

Direction: Bearish

Target: 71.75

Invalidation: 79.25

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.