As we head into December, Tesla Inc. has been a hot topic for Jim Cramer. Still, he warns investors against buying Tesla stock solely because of possible support from the incoming Trump administration. Cramer explains that while Tesla tells a compelling story with its advancements in self-driving technology and renewable energy, relying on government support for electric vehicles (EVs) nationwide is unrealistic. Instead, Tesla's value lies in its innovation and dominance as a tech company, not just an automaker.

Cramer believes Tesla doesn't need any added "Elon Musk premium" because its existing "Tesla premium" is already enough to justify its appeal to investors. Despite Tesla's strong position, some hedge funds and experts remain cautious, pointing out challenges like high interest rates and limited affordability of Tesla's vehicles for the average buyer. While Tesla ranks 2nd on Cramer's list of stocks heading into December, he suggests that investors might find more promising opportunities in under-the-radar AI stocks with higher growth potential and lower valuation.

If you're seeking affordable investment opportunities in AI with a solid future outlook, it might be worth exploring stocks trading at less than 5 times their earnings. Tesla remains a leader in innovation, but diversifying into other growing sectors could offer better returns.

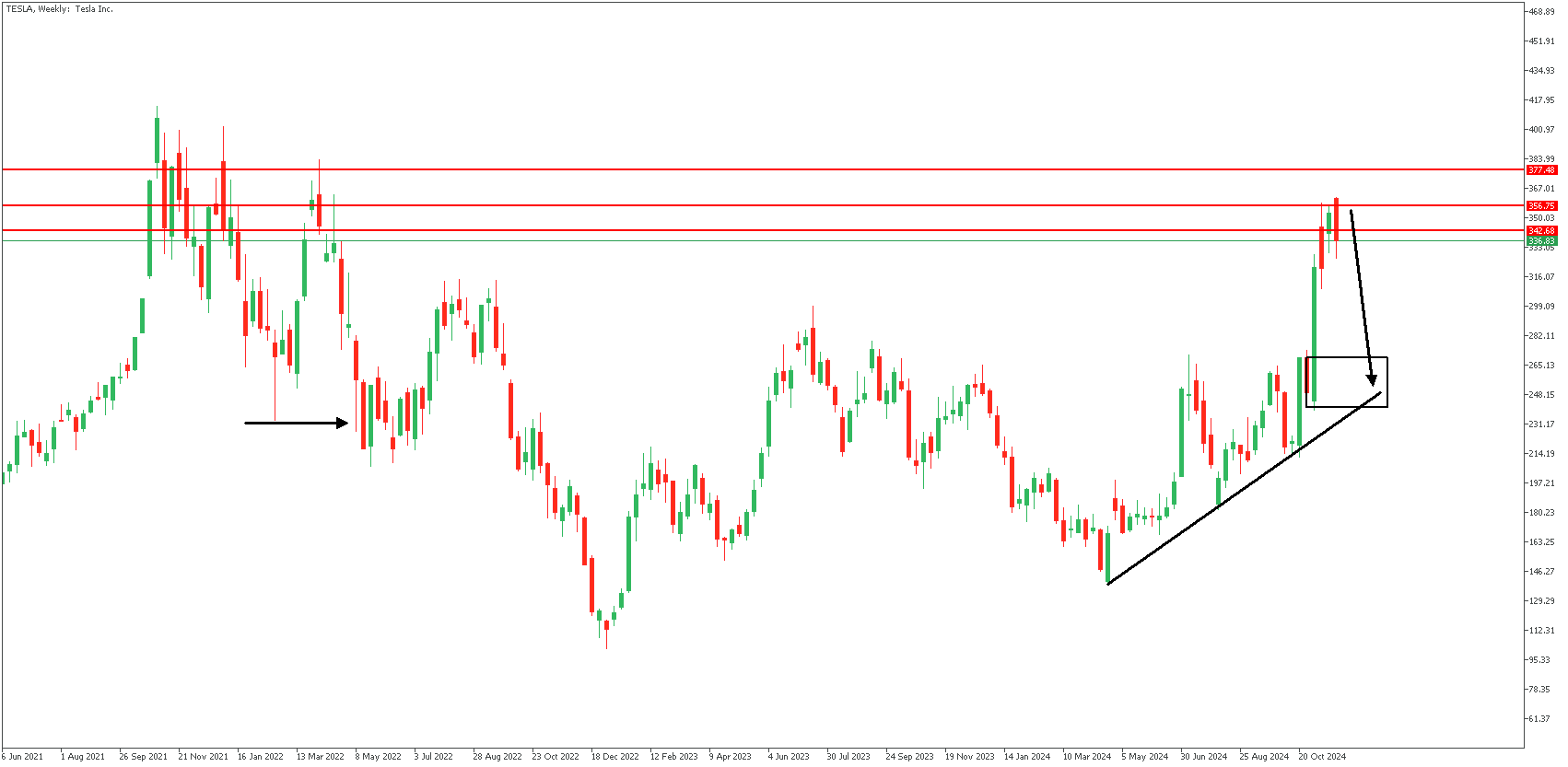

Tesla – W1 Timeframe

The price action on Tesla stock's weekly timeframe shows an initial rejection from the weekly pivot region. There is an FVG (Fair Value Gap) right behind the current price position, implying the need for the price to slip a bit lower to cover the FVG. The rally-base rally is the target region for the bearish movement, but let's see how this looks on the daily timeframe chart.

D1 Timeframe

.png)

The price has formed a double-top price action pattern on the daily timeframe chart, further confirming the bearish sentiment. There are a few additional confluences, but we must make do with these few.

Analyst's Expectations:

Direction: Bearish

Target:268.95

Invalidation:404.74

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.