The GBPAUD exchange rate has been weakening today ahead of the release of the US core PCE price index, which is expected to have a significant impact on global currency markets due to the size and influence of the US economy. Currently, GBPAUD is trading at A$1.9431, slightly down from its opening levels.

The Australian dollar (AUD) has remained strong despite weak economic data from China, Australia’s largest trading partner. China's industrial profits for August came in lower than expected, but the AUD has been supported by the Reserve Bank of Australia's (RBA) commitment to keeping interest rates high to control inflation. Additionally, stimulus measures from the People’s Bank of China (PBOC) aimed at boosting the Chinese economy have provided further support for the AUD.

Meanwhile, the British pound (GBP) has shown mixed performance today. While the latest UK distributive trades report showed an improvement, lack of further economic data has left investors cautious, especially with expectations that the Bank of England may cut interest rates before the end of the year.

The GBPAUD exchange rate may see further movement later today based on the release of US inflation data, which could influence the US dollar (USD) and, in turn, affect the Aussie and pound.

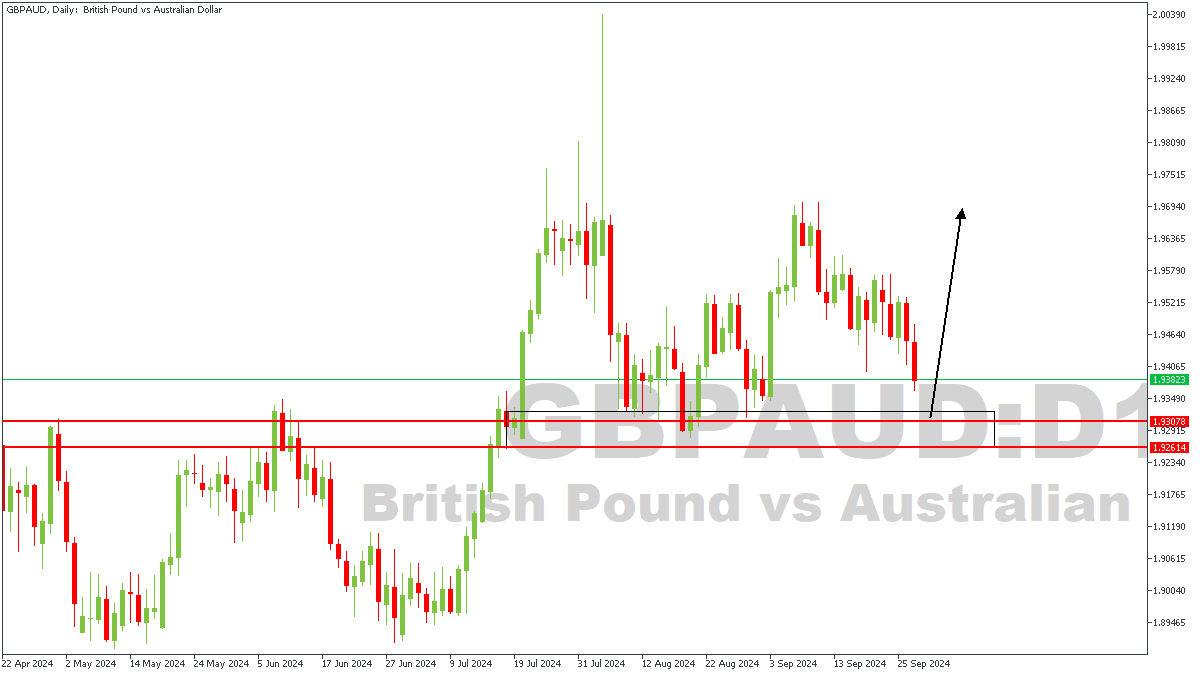

GBPAUD – D1 Timeframe

The current price action on the daily timeframe chart of GBPAUD is approaching a key pivot zone. The break above the previous high took place around this region, increasing the likelihood of an impactful reaction from the said zone. Now we can check the lower timeframe charts for clues as to the appropriate entry for this trade.

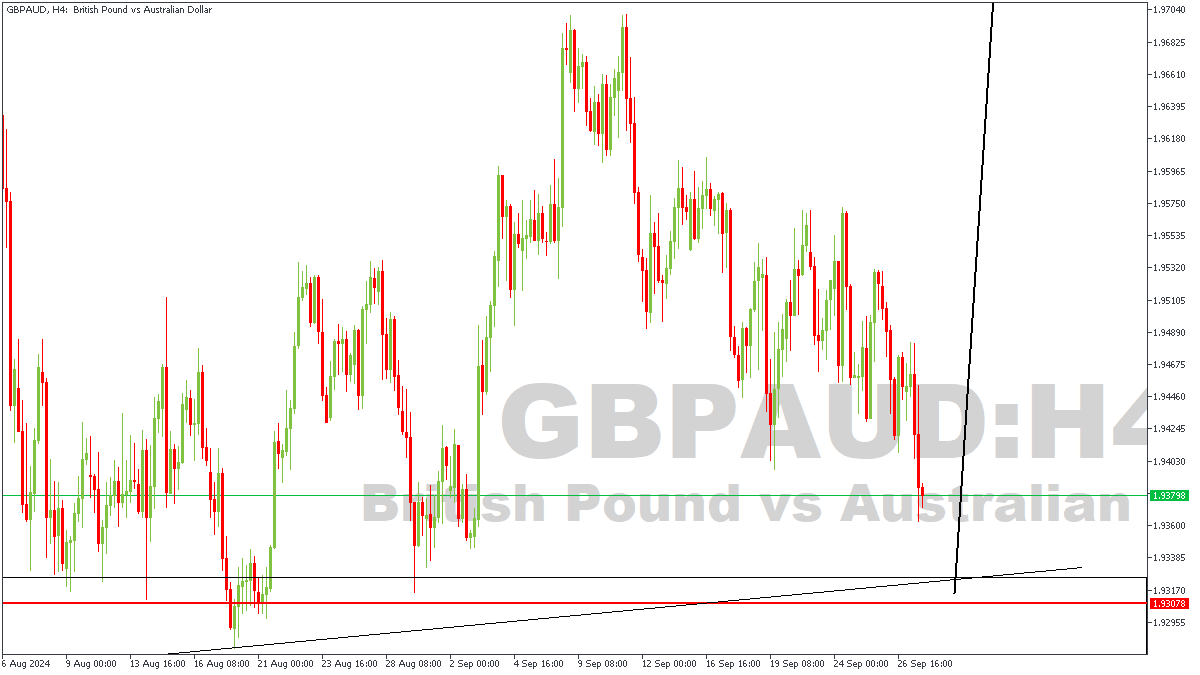

H4 Timeframe

On the 4-hour timeframe, we can see a trendline support, as well as a rally-base-rally from the demand zone, as highlighted by the rectangular shape. Combining the confluence from the trendline support and the demand zone with the daily timeframe confluences, I believe we should see some bullish momentum coming in on GBPAUD very very soon.

Analyst’s Expectations:

Direction: Bullish

Target: 1.94991

Invalidation: 1.92562

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.