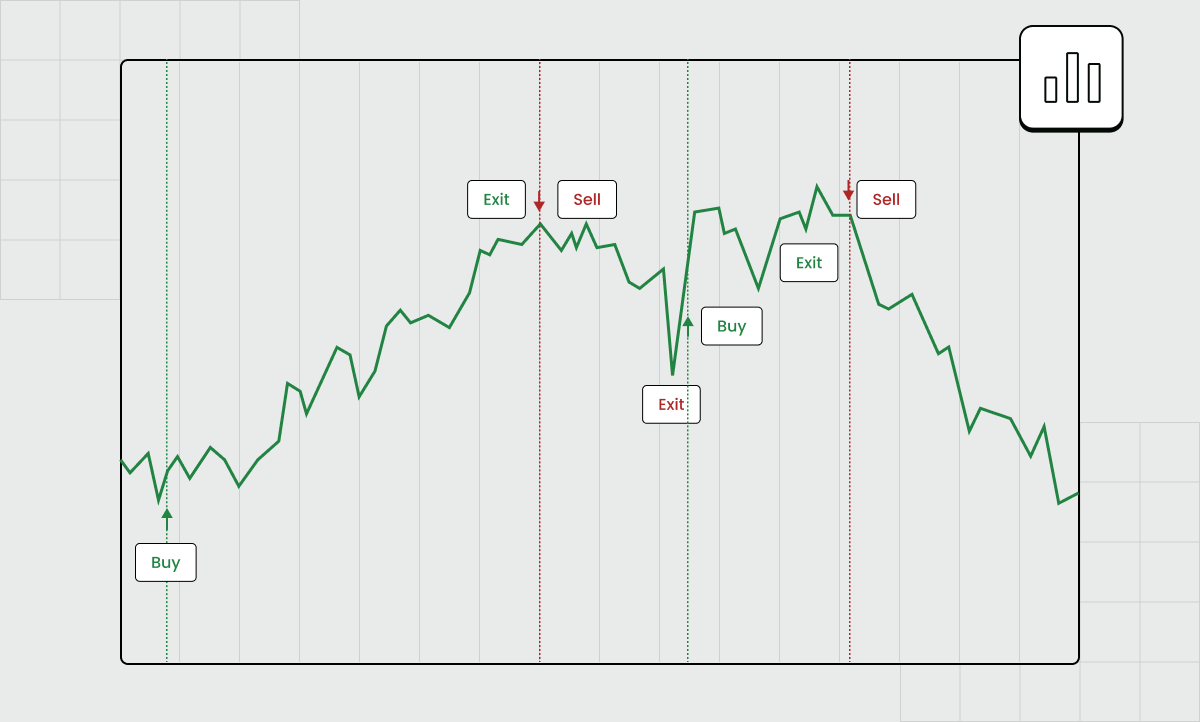

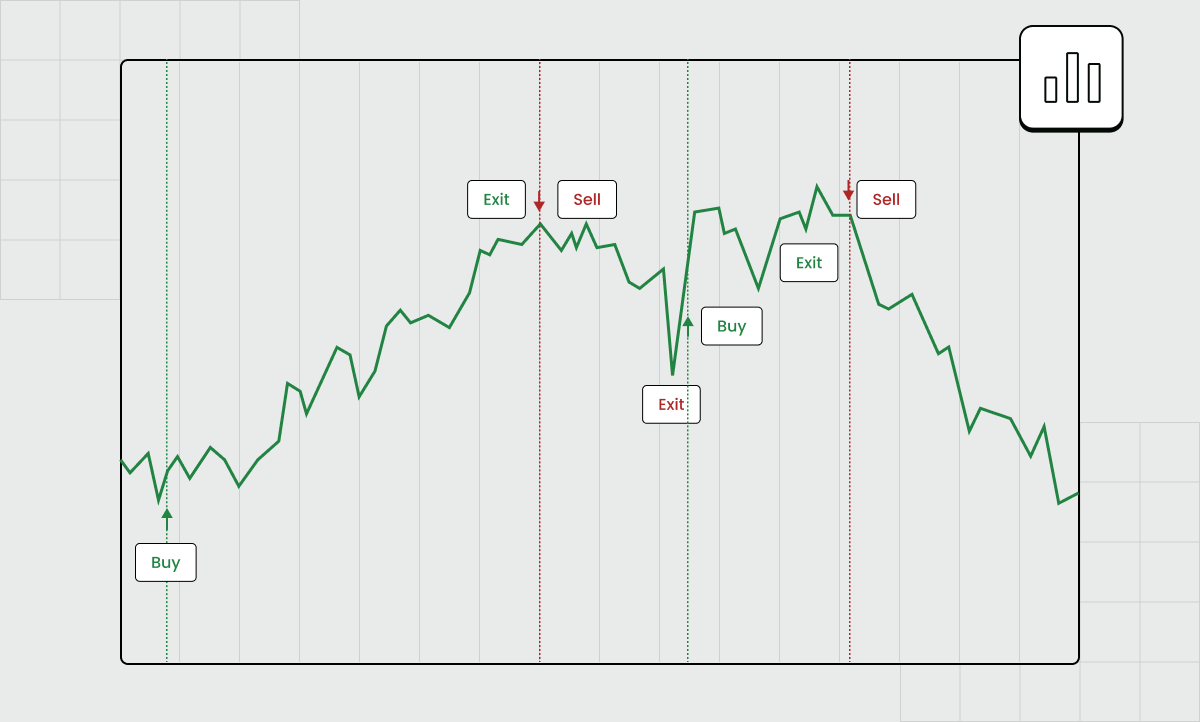

Tip six: Determine entry and exit points

Determining entry and exit points must become your ritual before every trade. You can hardly expect positive results if you just rush into a trade. Unless you are a risky type of trader, you will want more control over potential profit. So, knowing when exactly you open and close a trade is what you should be after.

Regarding risk management, you should also use tools like Stop Loss and Take Profit. The former will help you avoid unnecessary losses by setting a price at which the asset gets sold automatically on its way down. With Take Profit, the asset is sold automatically when it reaches a pre-set price on its way up.

Both Stop Loss and Take Profit let you optimize the trading process without keeping your eyes peeled for open positions.

Tip seven: Calculate expectancy

Another Forex advice that will take your skills up a notch is to assess how you will do in the long run. One trade doesn’t make a difference, so analyzing your trading on one single deal is no use. Instead, try to assess your results every ten trades.

You'll see how helpful it is, as this approach gives you a broader view of the process and helps you calculate income expectations.

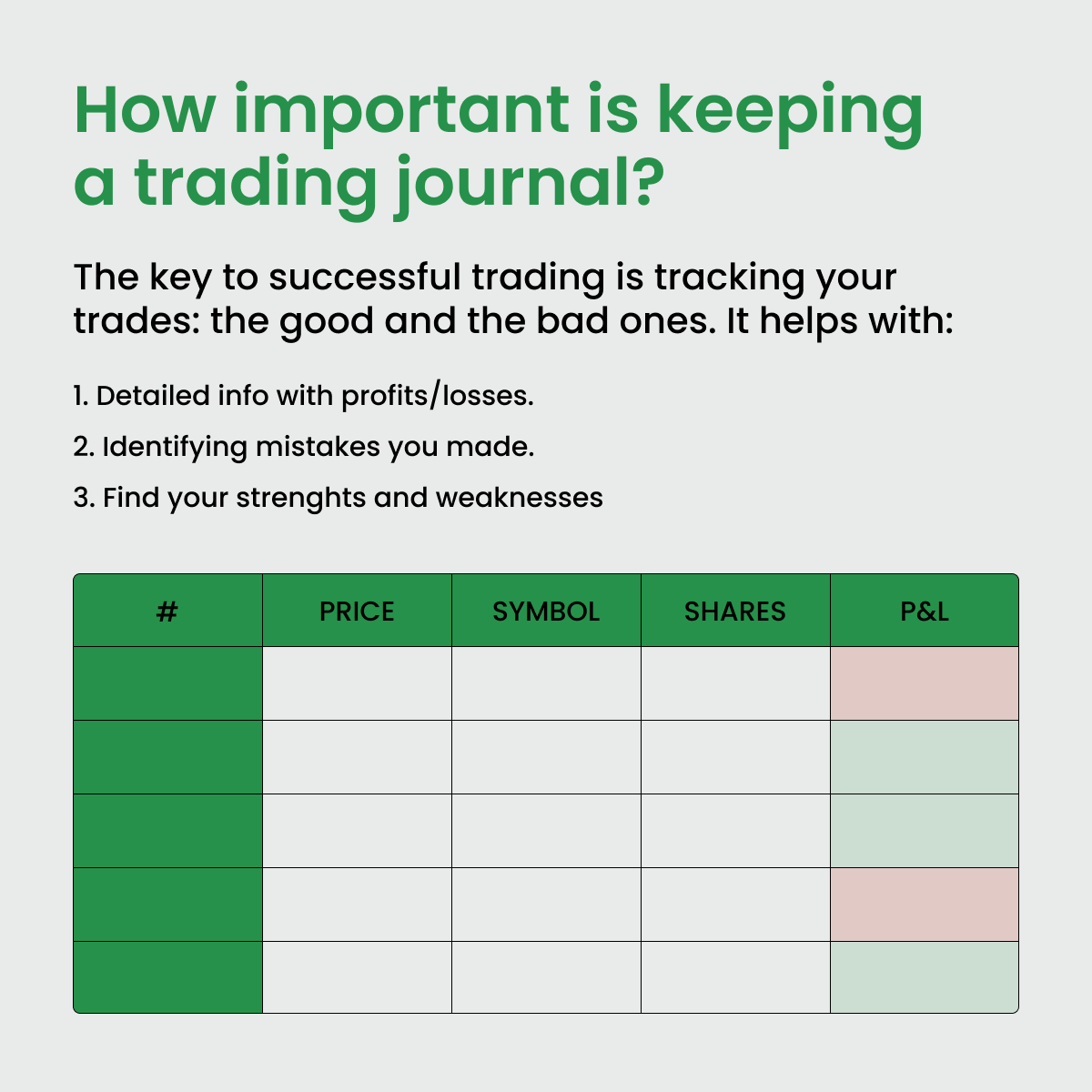

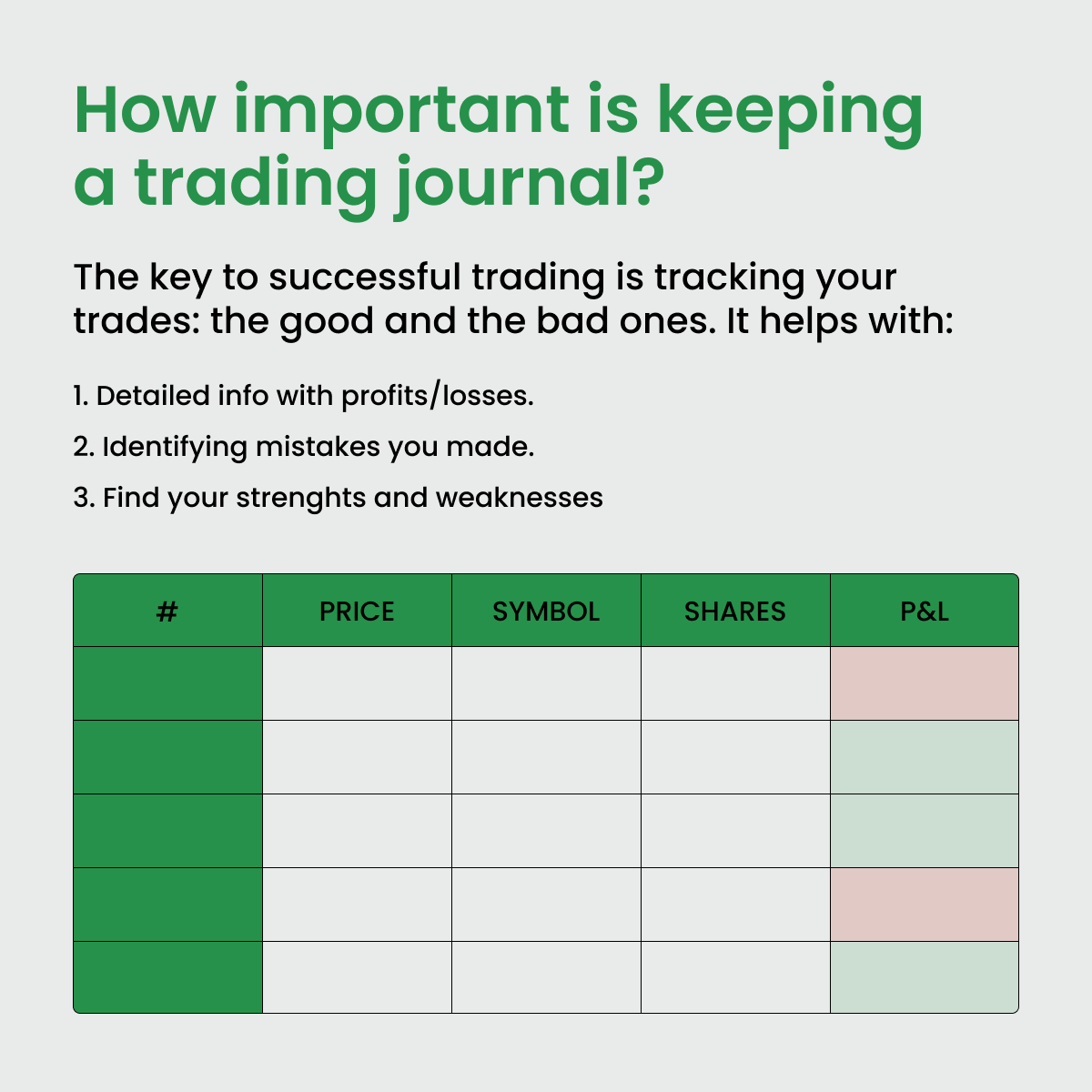

However, you can upgrade the whole process by keeping a trader’s journal.

The journal helps you to organize and optimize your trading. As you already know, focus and consistency are key characteristics of a successful trader. Keeping the journal will help you develop and maintain them.

Tip eight: Limit your losses

If you want to make a thoughtful and cautious trader, always set limits to potential losses. This means setting the threshold for how much you can lose without pulling your hair out.

Let's face it: losing is an unfortunate part of trading. But you can learn to avoid losses as much as possible or minimize the damage.

You may think big in terms of potential gains to keep yourself motivated. But it's best to think small when it comes to potential losses.

Tip nine: See what works best for you and why

If a pattern led to a favorable result or some kind of recurring "system" worked well, stick with it. Reward yourself for successful trades — as we all do — but when you do, don't forget to analyze why the trade was so efficient and how exactly you made it work.

This is one of the best tips for Forex trading that will help you build a "tacklebox" of helpful patterns, strategies, and tricks that you can use for future trades.

Tip ten: Do weekly and monthly analysis

Trading is a constant feedback loop. This means you can’t do without regular analysis of your experience and results. Do this every week and every month. This will help you spot your strong and weak points, work on mistakes, and become a better trader.

Use the journal for this. It will help you see where you went right and where you went wrong. You will be able to eliminate counterproductive strategies and failing assets. You don't need things that don't work — use the journal to spot them and cut them out of the process.

Wrap-up

Trading EURUSD is challenging. However, there are ways to master this skill. It will take time and effort, but eventually, it will pay off.

Start exploring trading EURUSD with these ten Forex trading tips. Incorporate them into your routine, use them when you practice with a demo account, and stay consistent.

Feel free to check out other articles in the FBS blog to expand your knowledge and find more Forex advice.