AUDUSD reversed its downtrend from the August 5 lows, establishing a new uptrend with potential gains toward the 200-period SMA around 0.6630. The pair's recovery, marked by a long Hammer candlestick on the 4-hour chart, indicates a strong reversal. A break above 0.6605 would confirm further upside, targeting 0.6639 where the 200-period and 50-day SMAs may temporarily limit gains. The pair's move above the 50 and 100 SMAs signals strong bullish momentum, with the RSI suggesting more room for growth.

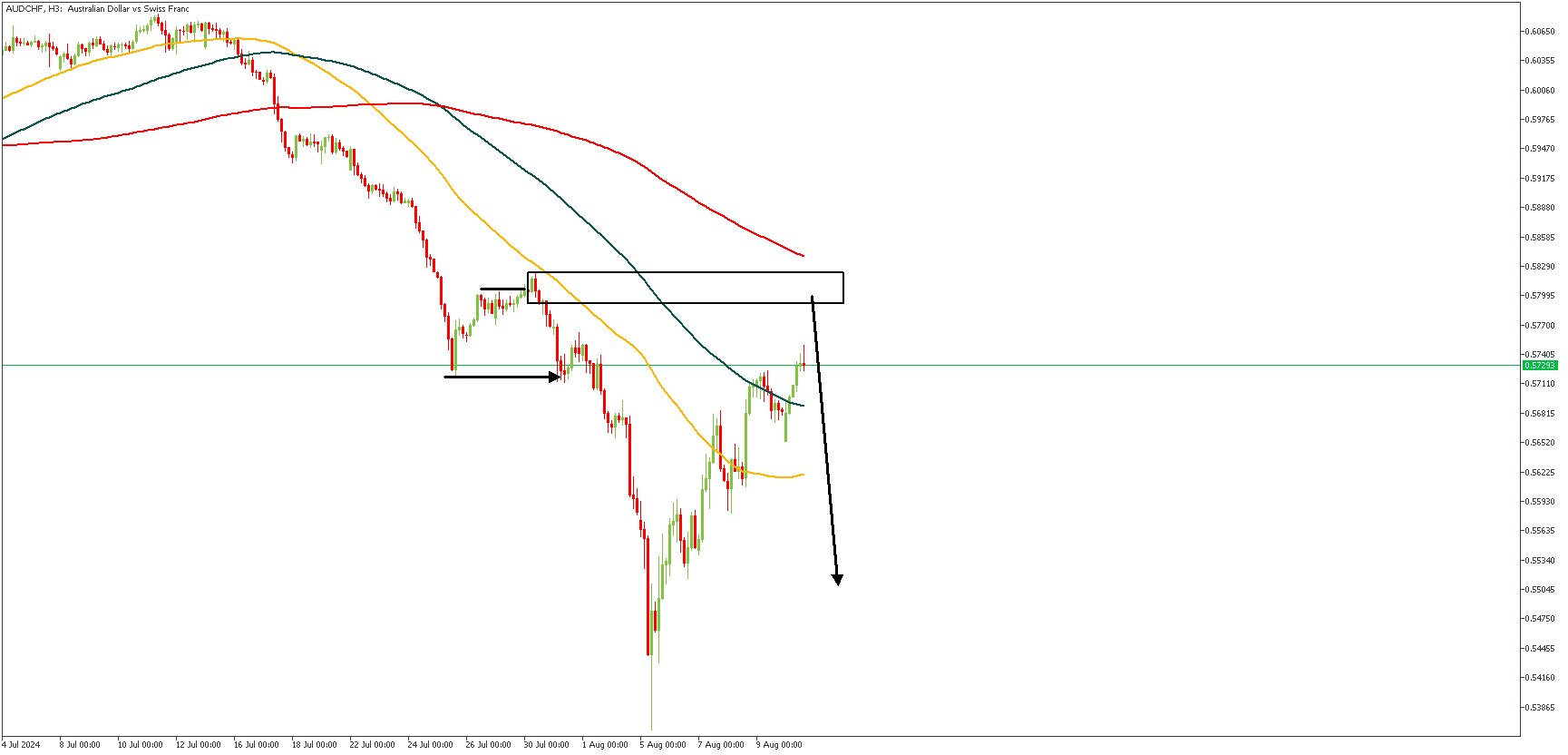

AUDCHF – H3 Timeframe

The SBR (Sweep-Break-Retest) price action pattern is the most prominent feature I can see here on the 3-hour timeframe of AUDCHF; price swept above the previous high, swung right down to break below the previous low, and then currently aiming towards the supply zone from the break of structure for a retest. The supply zone is my area of interest for a bearish entry.

Analyst’s Expectations:

Direction: Bearish

Target: 0.55340

Invalidation: 0.58426

GBPAUD – H4 Timeframe

.png)

On the 4-hour timeframe of GBPAUD price action chart, we see the initial break above the previous high to the left of the chart, as well as the moving average support from the 200-period moving average. The horizontal lines indicate that the highlighted region is a pivot zone and thus increasing the chances of a bullish reaction from the region. My overall sentiment in this case is bullish.

Analyst’s Expectations:

Direction: Bullish

Target: 1.97805

Invalidation: 1.92129

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.