It’s been another eventful Monday this week, 12th of August. As usual, the session kicked off with a review of the price action across the majors, as well as XAUUSD. In this article, I wish to share some of the conclusions from our live analysis during the market review livestream. Do remember, however, that your due diligence is required in order to make the most of these trade ideas.

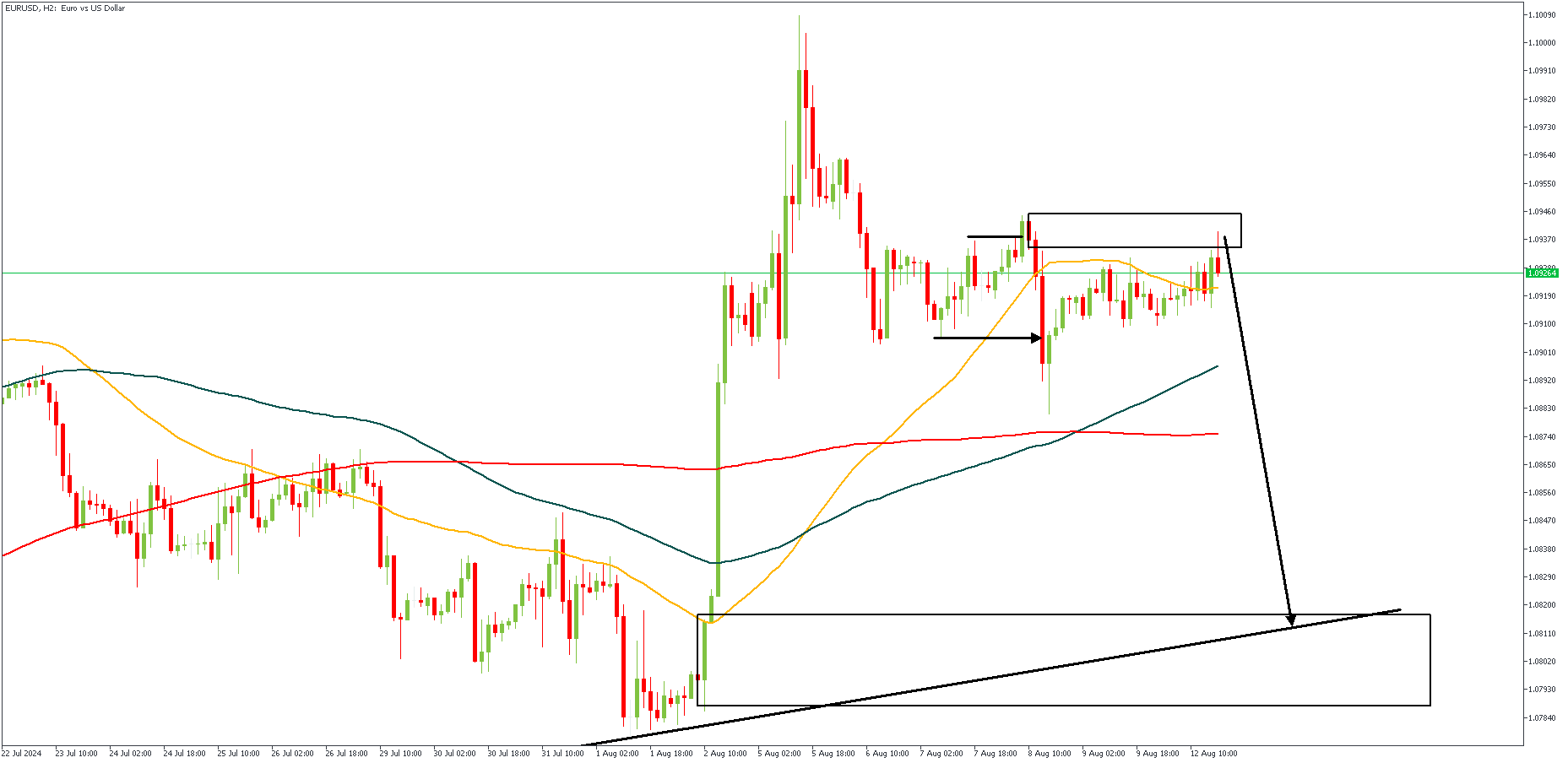

EURUSD – H2 Timeframe

The 2-hour timeframe chart of EURUSD seems to be gearing up for a bearish run. This sentiment is based on the SBR pattern that seems to be coming to completion already; right around the 50-period moving average. I consider it plausible to see price slide lower to break below the low, and thereafter aim for the highlighted demand zone at the trendline support. My sentiment in this regard is bearish as earlier mentioned.

Analyst’s Expectations:

Direction: Bearish

Target: 1.08150

Invalidation: 1.09640

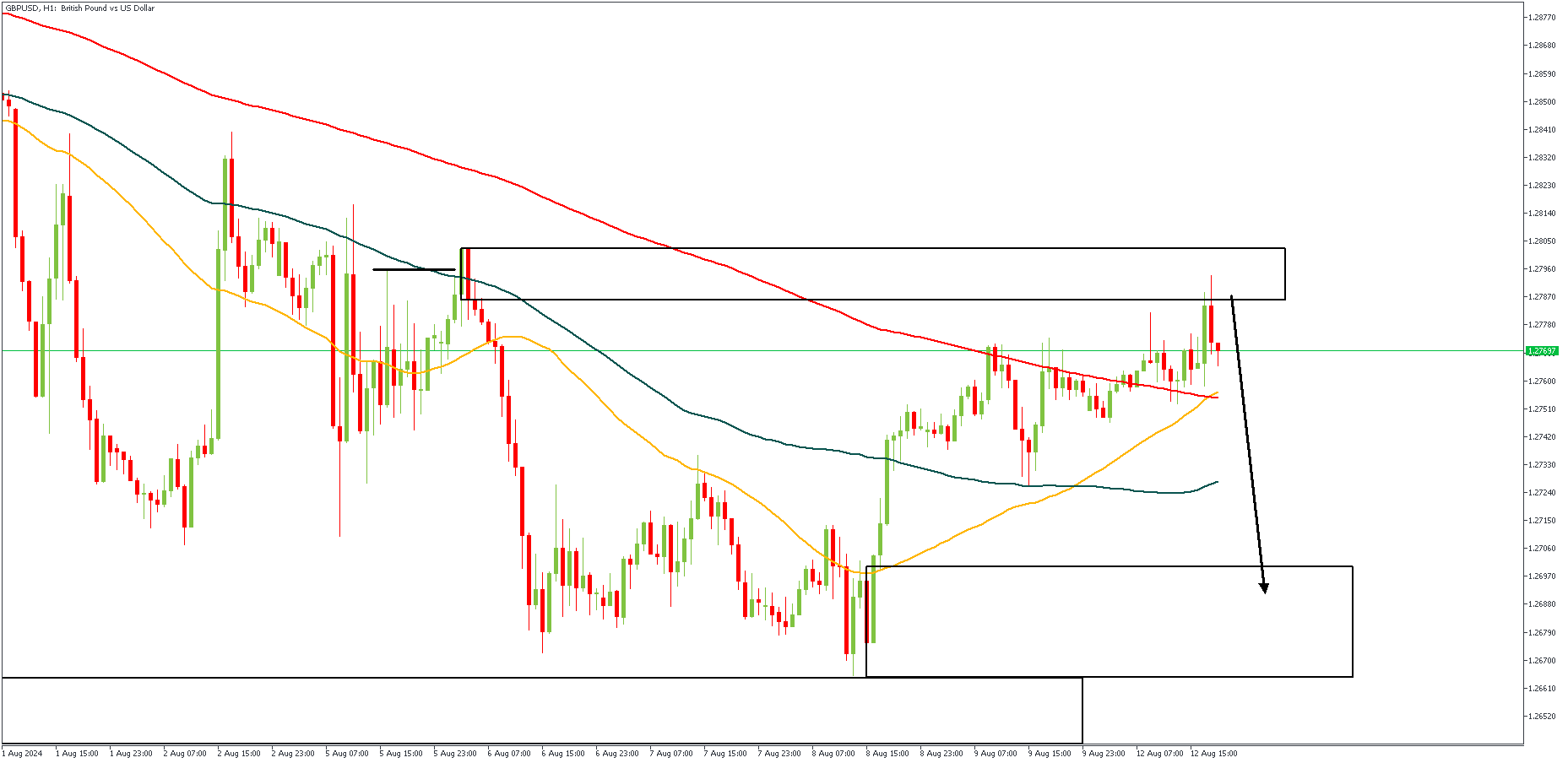

GBPUSD – H1 Timeframe

GBPUSD seems to be presenting a similar price action to what we saw earlier on the EURUSD chart. In the case of GBPUSD though, the pattern seems a lot clearer, with the 200-period moving average acting as a possible area of rejection. We may get to see prices slip until it reaches the demand zone highlighted at the bottom of the price action chart.

Analyst’s Expectations:

Direction: Bearish

Target: 1.26880

Invalidation: 1.28120

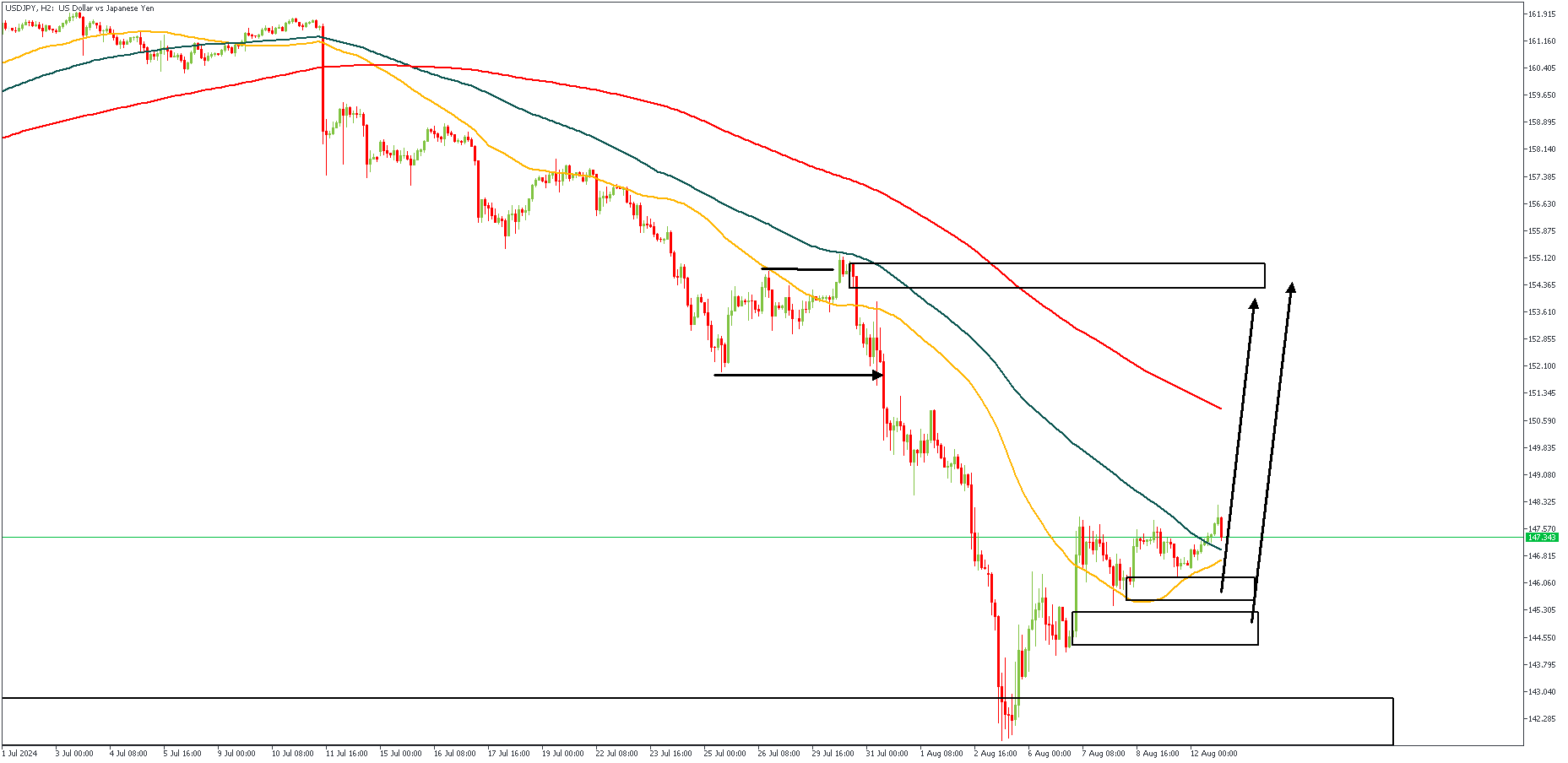

USDJPY – H2 Timeframe

Following the live analysis from the previous week’s session, we’ve seen a 540-pip rise in the USDJPY rates, though price seems to be gearing up for even more. The current stall in the movement of price suggests that price is seeking a strong area of confluence to use a launchpad. I have highlighted two likely demand zones to this end, in hopes that you, my dear reader, will pay attention to the lower timeframes in search of your entry trigger. The overall bullish sentiment however remains intact.

Analyst’s Expectations:

Direction: Bullish

Target: 154.250

Invalidation: 141.910

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.