The USDCAD pair dipped on Thursday, ending its three-day winning streak as the US Dollar softened slightly during the European session. However, the drop was limited, with the pair staying around the mid-1.4000s ahead of key employment data from the US and Canada, set to be released on Friday.

While the US dollar faced some pressure, rising US Treasury bond yields, supported by expectations that the Federal Reserve would remain cautious about cutting interest rates, provided some support. Hawkish comments from Federal Reserve officials, including Chair Jerome Powell, suggest the central bank might pause rate cuts or even consider raising rates if inflation picks up again under the policies of US President-elect Donald Trump.

Meanwhile, crude oil prices, which usually impact the Canadian Dollar (CAD), remained under pressure due to concerns about weaker demand, especially from China. At the same time, geopolitical tensions and expectations that OPEC+ will delay any production increases until mid-2025 helped stabilize oil prices but didn’t boost the CAD significantly. As a result, the USD/CAD pair stayed relatively steady, with traders cautious ahead of Friday’s job market updates.

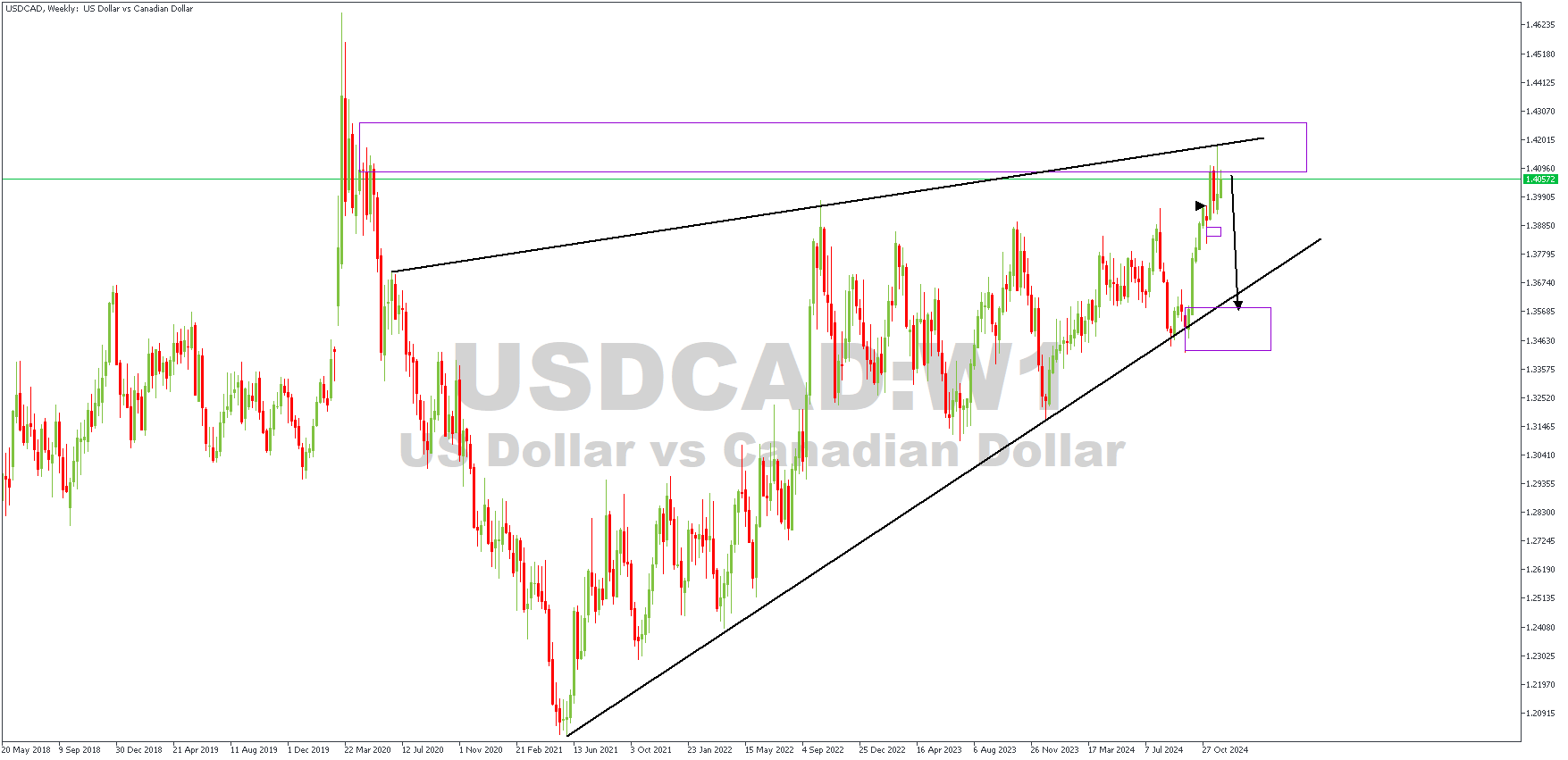

USDCAD – W1 Timeframe

The weekly timeframe price action on USDCAD’s chart shows price contracting within a rising wedge, with a very recent bounce off the trendline resistance of the consolidation pattern. Also worthy of note is the rally-base-drop supply zone that overlaps the resistance trendline. Now that the weekly timeframe sentiment is bearish, let’s see how well the lower timeframe aligns.

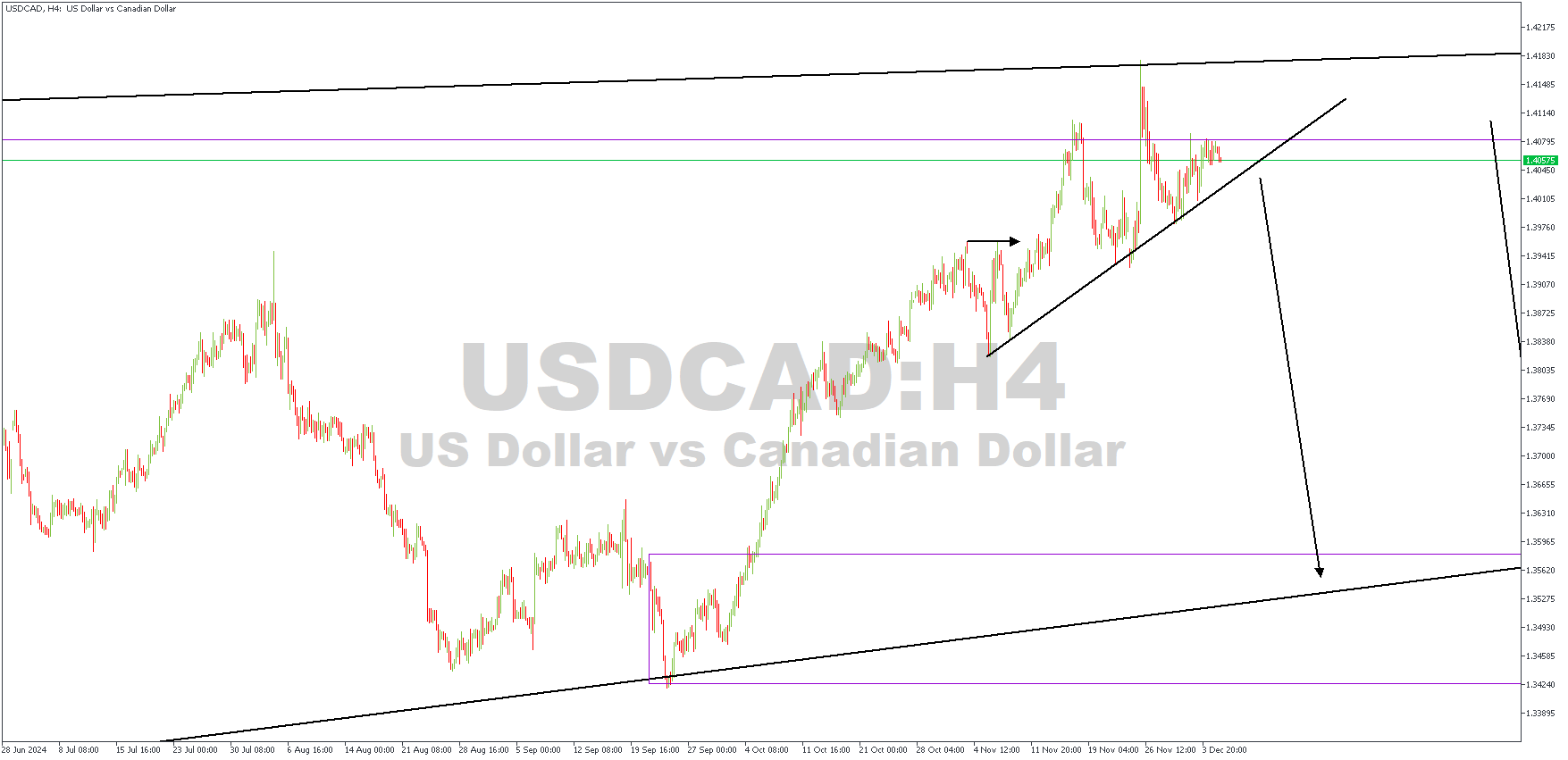

H4 Timeframe

Despite the bearish sentiment from the weekly timeframe, we are still waiting to see an apparent change of character from the market structure on the 4-hour timeframe. The fact that the price has yet to create a new lower low suggests that some caution would be required until after the bullish structure has been broken.

Analyst’s Expectations:

Direction: Bearish

Target: 1.36057

Invalidation: 1.42033

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.