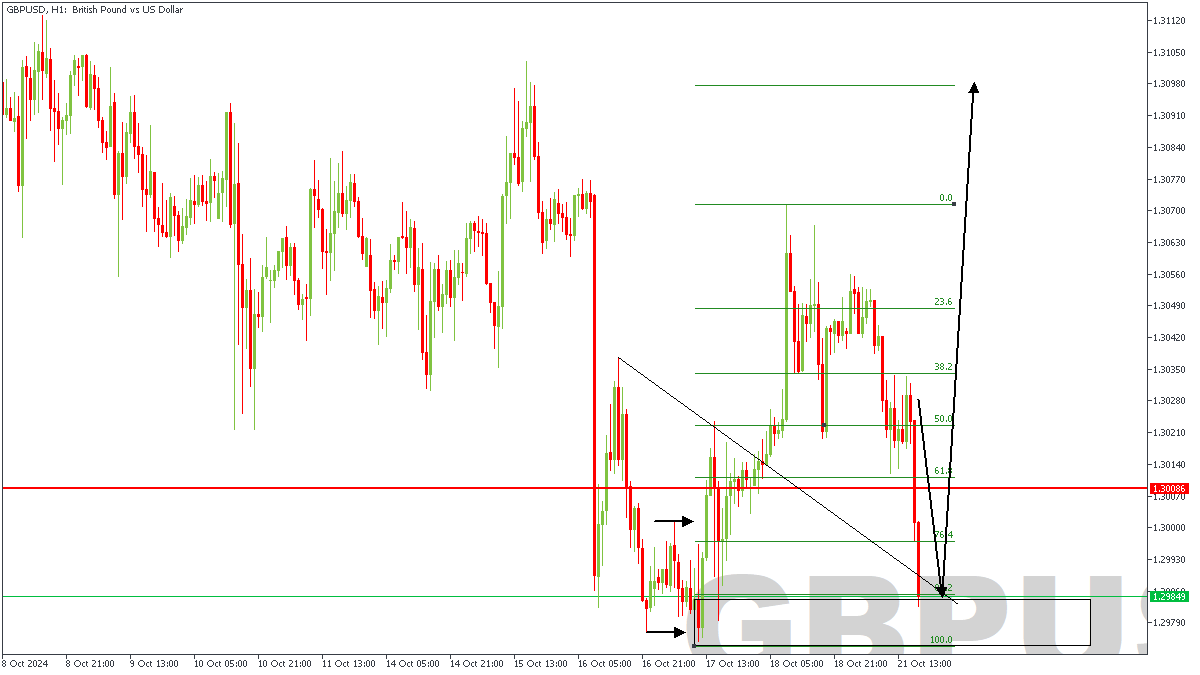

GBPUSD – H1 Timeframe

Last week GBPUSD closed with a clear bullish reaction from the daily timeframe pivot zone, causing a bullish break of structure as a result of the momentum. The price action thereafter created a SBR (Sweep-Break-Retest) structure where price is currently retesting the second shoulder of the inverted Head-and-shoulder pattern.

• The break and retest of the trendline;

• Sweep-Break-Retest market structure pattern;

• Inverted Head and Shoulders pattern;

• 88% of the Fibonacci retracement level;

• Daily timeframe pivot zone

Analyst’s Expectations:

Direction: Bullish

Target: 1.30948

Invalidation: 1.29684