BlackRock's Bitcoin exchange-traded fund (ETF) has seen no new investments for two days, signaling a drop in interest from institutional investors despite the ongoing cryptocurrency market rally. According to data from Farside Investors, the last recorded inflow for BlackRock's IBIT ETF was on November 25, surprising many, as BlackRock has historically supported the ETF market during challenging times.

Market analysts believe this hesitation comes from Bitcoin's price volatility, which has made institutional investors more cautious. While BlackRock's ETF stalled, other players like Bitwise and Grayscale continued to see positive inflows, with Bitwise pulling in $6.5 million and $48 million on November 26 and 27, respectively, and Grayscale reporting $4.8 million and $12 million. However, these inflows weren't enough to offset a total market outflow of $122.8 million on November 26.

This development is surprising for BlackRock, especially after the fund reached major milestones earlier this year, surpassing $40 billion in assets in just 211 days. Analysts suggest that investor caution lingers until a more stable environment exists in the cryptocurrency market. Currently, Bitcoin is trading at $95,269.74, up 0.7% in the last 24 hours, with its recent high at $97,357.

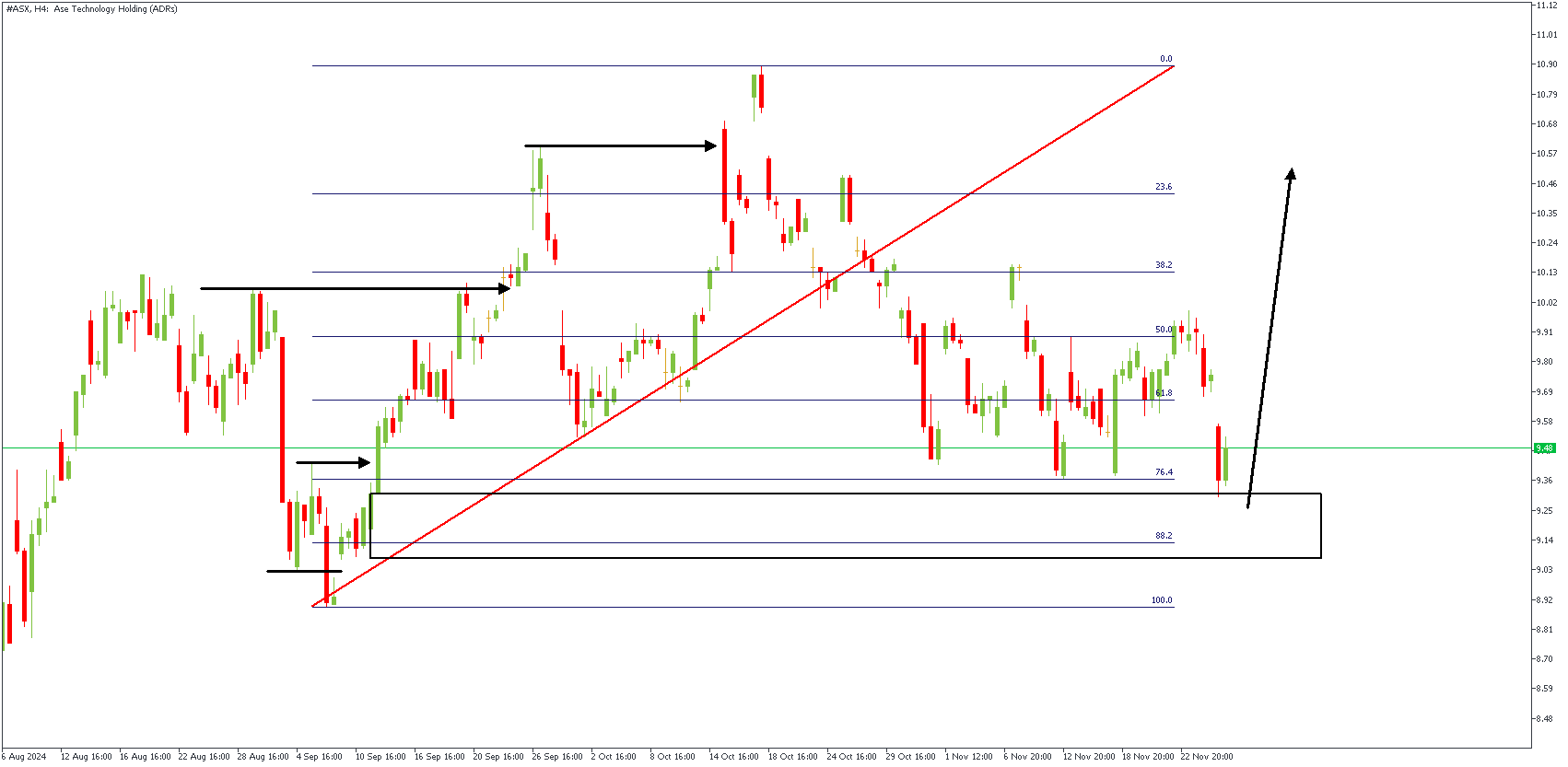

AXS – H4 Timeframe

The current price on the 4-hour chart of AXS shows the price reacting off the demand zone of a critical SBR (Sweep-Break-Retest) pattern. The 76% Fibonacci retracement level is another crucial confluence in favor of the bullish sentiment, with the double bullish break of structure.

Analyst's Expectations:

Direction: Bullish

Target:10.71

Invalidation:8.78

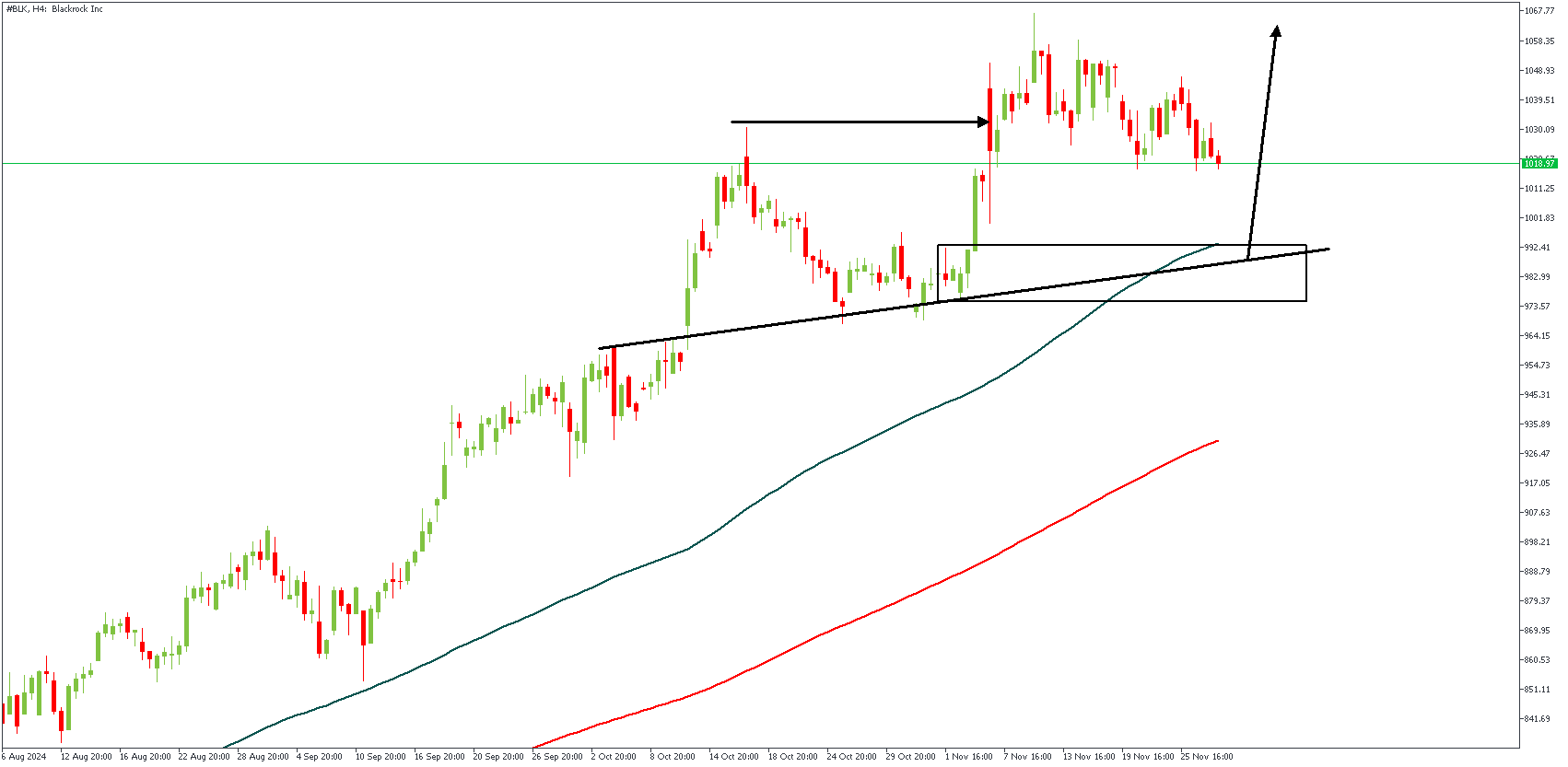

BLK – H4 Timeframe

Blackrock stock prices have recently created a new high following the double bottom pattern at the retest of the trendline support. At the moment, a retest of the demand zone is expected, at which point the confluence with the trendline support and the 88% Fibonacci retracement level are the target areas for entry.

Analyst's Expectations:

Direction: Bearish

Target:1059.09

Invalidation:951.70

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.