A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

2024-03-28 • Atualizado

Robert Kiyosaki, the author of "Rich Dad Poor Dad," has updated his bitcoin price forecast, now projecting the cryptocurrency to hit $100,000 by September. He plans to acquire more bitcoin before April, attributing his decision to the upcoming halving event. Kiyosaki advises investors to consider adding bitcoin to their portfolios and suggests silver as an alternative investment. He underscores the importance of taking action and acquiring real assets like silver and bitcoin. Kiyosaki has been increasingly vocal about his support for BTC, urging investors to buy as much as they can afford and predicting a $300,000 price target for this year. Let’s see if the technical factors agree with Robert’s point-of-view.

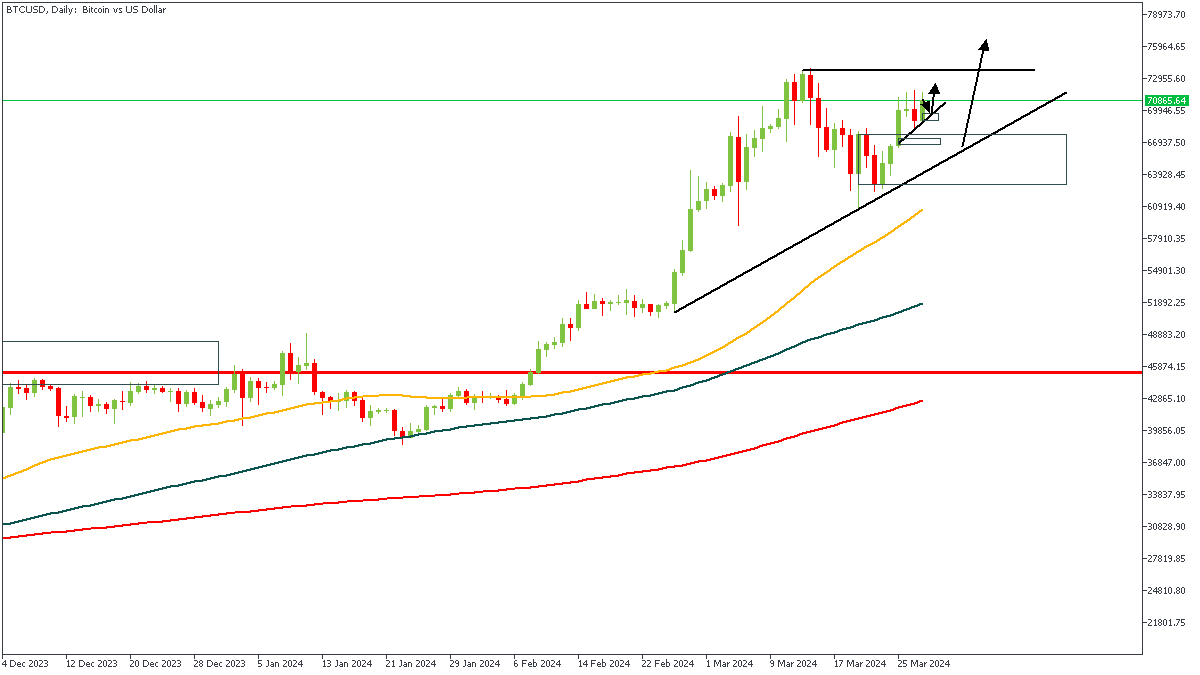

Bitcoin (BTCUSD) as seen on the daily timeframe chart above is currently in an overall uptrend - as defined by the consecutive higher highs and lows, as well as the bullish array of the moving averages. There is also a trendline support on the daily timeframe, though I do not expect price to drop that far in the meantime.

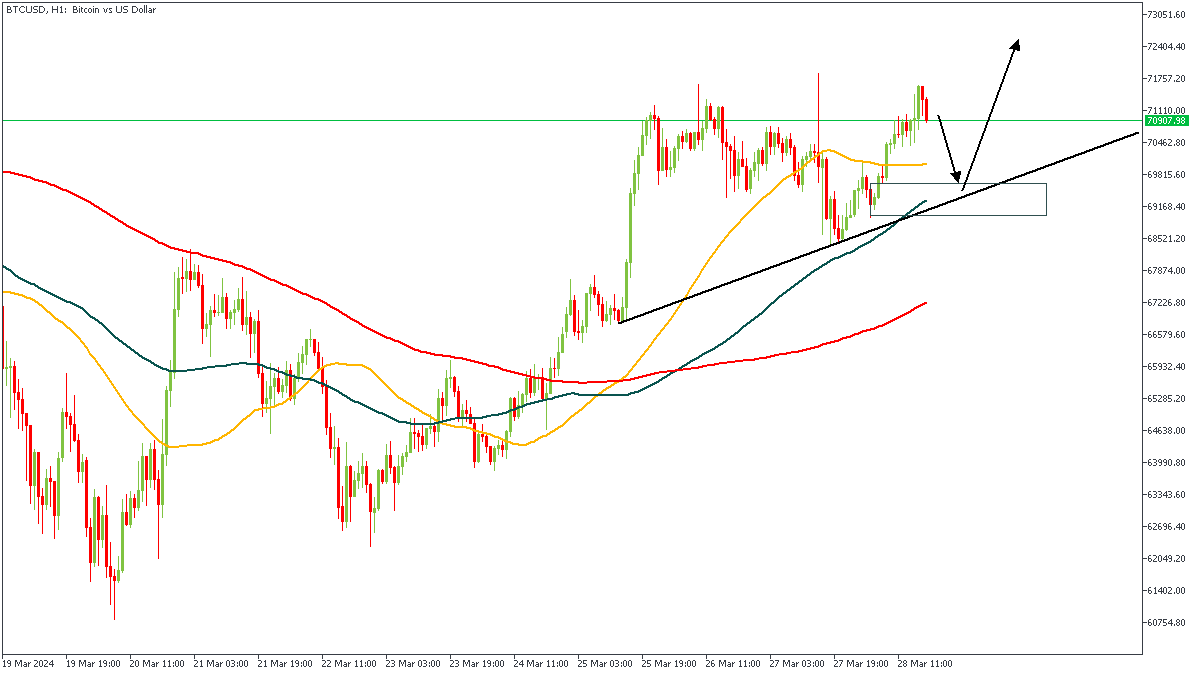

The trendline support on the 1-hour timeframe seems more feasible as a target for the resumption of bullish pressure due to the fact that the trendline aligns perfectly with the 100-period moving average, as well as a drop-base-rally demand zone. In line with this, my sentiment on BTCUSD remains clearly bullish.

Analyst’s Expectations:

Direction: Bullish

Target: $75,000

Invalidation: $68,000

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

As especulações de que as autoridades do BOJ irão intervir para conter qualquer fraqueza adicional do JPY mantêm um limite para quaisquer ganhos adicionais

Opiniões divergentes dos oradores do Fed sobre cortes de taxas prejudica o desempenho do USD

Depois da queda no mês de março em cerca de 26 mil vagas de emprego, a expectativa do mercado é de nova queda para 8,790M para o mês de fevereiro do mesmo ano

Nesta segunda-feira, primeiro dia do mês de abril, os EUA liberam os números dos PMIs da S&P Global e do ISM para a indústria

Todas as atenções estarão nos preços básicos do PCE (núcleo) dos EUA, que excluem alimentos e energia para o mês de março, com a expectativa de que os números venham abaixo do mês anterior, que registraram um aumento de 0,4%

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “Aceitar“, você concorda com nossa Política de Privacidade.

Seu pedido foi aceito

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em

Se você tiver um problema urgente, por favor, fale conosco pelo

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!