A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

2022-05-26 • Atualizado

Inflation (= meaning the generalized and continuous increase of prices in an economy) is a very important economic phenomenon, affecting practically all investments in financial assets in the capital market. Therefore, for investors and traders alike it is highly recommended to understand the dynamics of inflation and some of its causes. One of the causes that influences inflation is the level of economic activity. When an economy is heated, with very low unemployment and a sufficient demand pressure, prices tend to accelerate, causing inflation. This also occurs due to pressure for wage increases in the labor market, which causes companies to transfer these costs to the prices of their products and services. This increase in wages and prices, if strong, can therefore cause inflation.

A second cause of inflation can be exchange rate devaluation. With exchange/currency devaluation, imports become more expensive, and this can lead to an increase in prices in the domestic market for products that depend precisely on imports from abroad, reflecting on the entire economy. With exchange appreciation, in turn, inflation tends to fall. A third cause of inflation is considered to be supply shocks, representing an increase in the prices of important inputs (such as commodities), which tend to affect the entire economy as well, such as gasoline and petroleum-derived fuels. In any case, what are the main indicators of inflation in an economy? Usually these indicators involve the so-called 'consumer price indexes' which are collected by the statistics departments of each country.

In the FBS economic calendar, our traders can find some important indicators regarding inflation:

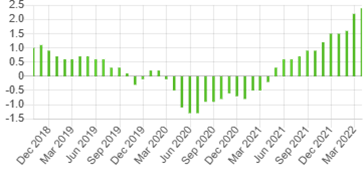

We see for example that the increase in the Swiss inflation rate between April 2021 (0.3%) and March 2022 (2.4%) appeared to have been (in part) a reflection of the devaluation of the franc (CHF) against its international peers, mainly the USD. In the chart below, we see the appreciation of the USD against the CHF in the period indicated.

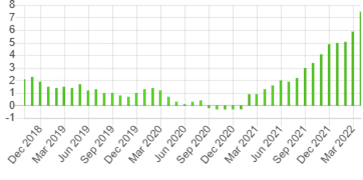

We see for example that the increase in the Eurozone inflation rate between January 2021 (0.9%) and March 2022 (7.5%) appeared to have been (in part) a reflection of the devaluation of the Euro (USD) against its international peers, especially the USD. In the chart below we see the devaluation of the EUR against the USD in the period indicated.

A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

As especulações de que as autoridades do BOJ irão intervir para conter qualquer fraqueza adicional do JPY mantêm um limite para quaisquer ganhos adicionais

Opiniões divergentes dos oradores do Fed sobre cortes de taxas prejudica o desempenho do USD

Depois da queda no mês de março em cerca de 26 mil vagas de emprego, a expectativa do mercado é de nova queda para 8,790M para o mês de fevereiro do mesmo ano

Nesta segunda-feira, primeiro dia do mês de abril, os EUA liberam os números dos PMIs da S&P Global e do ISM para a indústria

Todas as atenções estarão nos preços básicos do PCE (núcleo) dos EUA, que excluem alimentos e energia para o mês de março, com a expectativa de que os números venham abaixo do mês anterior, que registraram um aumento de 0,4%

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “Aceitar“, você concorda com nossa Política de Privacidade.

Seu pedido foi aceito

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em

Se você tiver um problema urgente, por favor, fale conosco pelo

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!