A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

2021-10-04 • Atualizado

Bank of Japan Governor Kuroda says Japan's economy will continue to recover and may reach the pre-pandemic level at the end of this year or early next year. But less than a week ago we heard a lot of opposite statements from him. What is happening with Japan’s economy and are the dark times beginning for JPY? It’s time to find out!

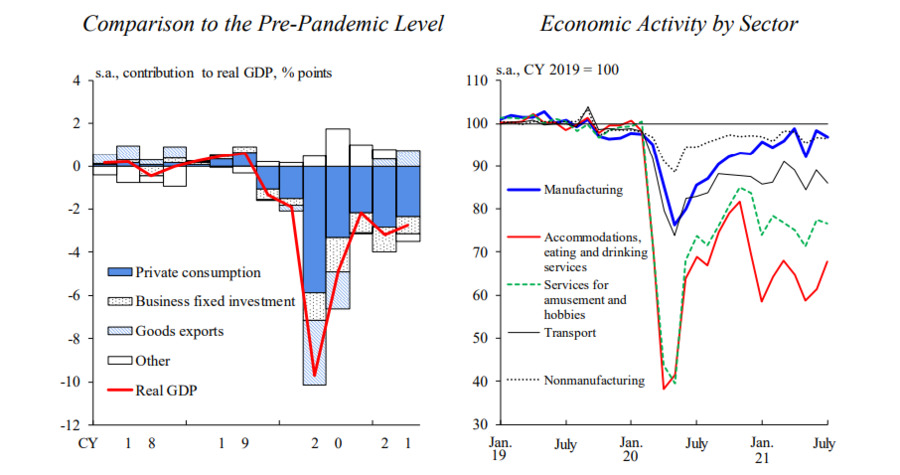

A year and a half ago, in 2020, when the first state of emergency was declared, the real GDP of Japan fell by about 10% compared with the level before the pandemic, and a wide range of economic activities were negatively affected. Since that Japanese economy tried to recover – in the next six months after the start of the pandemic real GDP has regained more than 60% of initial loss – but after that, the pace of the recovery has gradually slowed down. Even now economic activity in Japan is under pre-pandemic levels, with no signs of improvement.

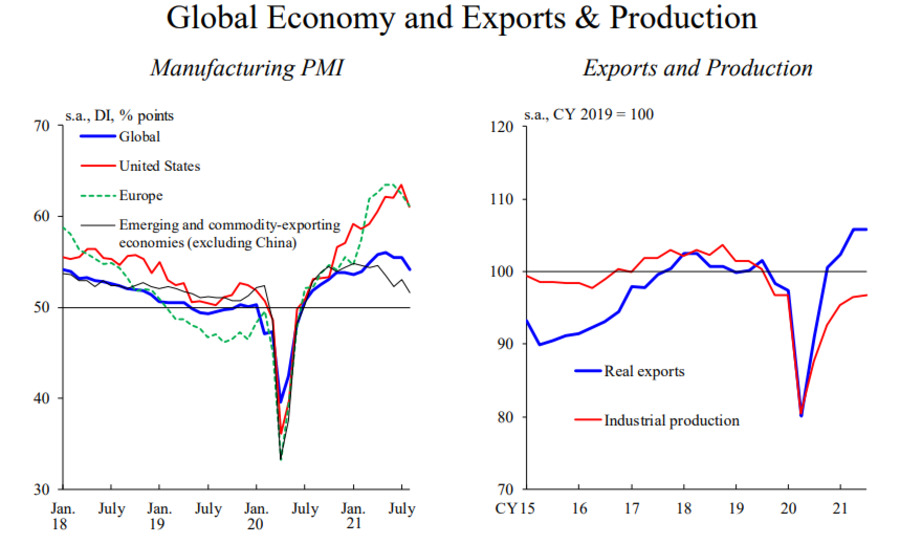

Even if we look at more positive data (PMI, exports, and production), Japan is struggling to reach the success of Europe and the United States. Asian factory shutdowns caused by the pandemic are likely temporary and could be fixed in the coming months, but capital expenditures are increasing in corporate sector.

The slow pace of the recovery is the reason for BOJ to hold the interest rate on the current level and to take more actions in response to Covid-19. For example, purchases of commercial papers and corporate bonds will be set at about 20 trillion yen ($180 billion), at maximum (the previous amount was about 5 trillion yen ($45 billion)). The BOJ extended the duration of the support program until the end of March 2022. Kuroda said that Japan's economy will continue to recover and could reach levels seen before the coronavirus pandemic by the end of this year or early in 2022.

With consumption weak and inflation well below its 2% target, however, the BOJ will maintain its massive stimulus regardless of the new government's policies. Also, to achieve and maintain target inflation, the BOJ guides short-term interest rates to -0.1% and long-term rates to around zero. That is pressing on the yen even more.

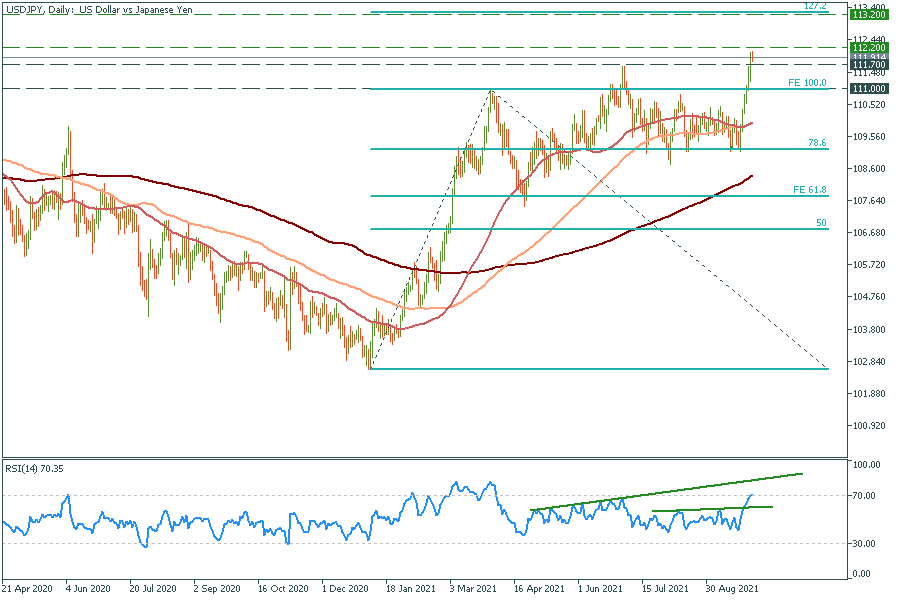

From the technical side, there is nothing to worry about: the downtrend of JPY isn’t going to stop any time soon. USD is feeling great and now is rushing through half a year consolidation. With or without some pullback, the yen will fall.

USD/JPY daily chart

Resistance: 112.2; 113.2; 116.2

Support: 111.7; 111.0

A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

As especulações de que as autoridades do BOJ irão intervir para conter qualquer fraqueza adicional do JPY mantêm um limite para quaisquer ganhos adicionais

Opiniões divergentes dos oradores do Fed sobre cortes de taxas prejudica o desempenho do USD

Depois da queda no mês de março em cerca de 26 mil vagas de emprego, a expectativa do mercado é de nova queda para 8,790M para o mês de fevereiro do mesmo ano

Nesta segunda-feira, primeiro dia do mês de abril, os EUA liberam os números dos PMIs da S&P Global e do ISM para a indústria

Todas as atenções estarão nos preços básicos do PCE (núcleo) dos EUA, que excluem alimentos e energia para o mês de março, com a expectativa de que os números venham abaixo do mês anterior, que registraram um aumento de 0,4%

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “Aceitar“, você concorda com nossa Política de Privacidade.

Seu pedido foi aceito

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em

Se você tiver um problema urgente, por favor, fale conosco pelo

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!