A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

2024-03-07 • Atualizado

The USD Index (DXY) dipped below the 103.00 support level for the first time since early February, indicating a significant decline in the US dollar. The focus on March 8 will be on the release of Non-farm Payrolls, the Unemployment Rate, and a speech by the Fed’s J. Williams. EURUSD reached new multi-week highs near 1.0950 after the ECB decided to maintain monetary conditions unchanged. GBPUSD surged to fresh 2024 highs above 1.2800, driven by increased selling pressure on the US dollar. USDJPY fell to new five-week lows below the 148.00 support level, influenced by lower US yields and speculation about the BoJ’s potential actions.

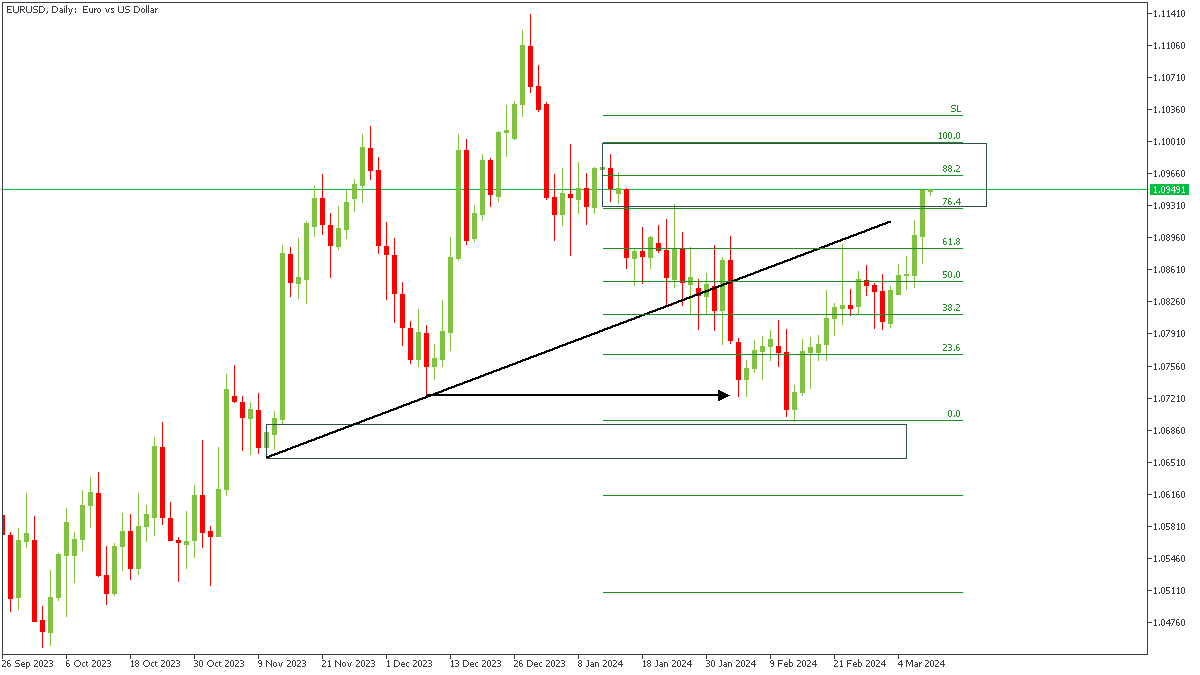

Following the violation of the previous low as indicated by the horizontal arrow, we’ve seen price action on the Daily timeframe of EURUSD climb back up rather quickly to retest the recent supply zone that brought about the break of structure. There is also a resistance trendline, as well as the Fibonacci retracement levels which could be considered as confluences in favour of a bearish sentiment.

Analyst’s Expectations:

Direction: Bearish

Target: 1.08568

Invalidation: 1.10040

The daily timeframe of GBPUSD, following the break below the previous low, is currently trading within the supply zone formed right before the break of structure. As a result, I am considering the possibility of a bearish pressure on GBPUSD as a result of the NFP data; this is based off of the Fibonacci retracement levels and the supply zone purely - I’ll be cautious here though, since there aren’t several confluences to consider.

Analyst’s Expectations:

Direction: Bearish

Target: 1.26629

Invalidation:1.30024

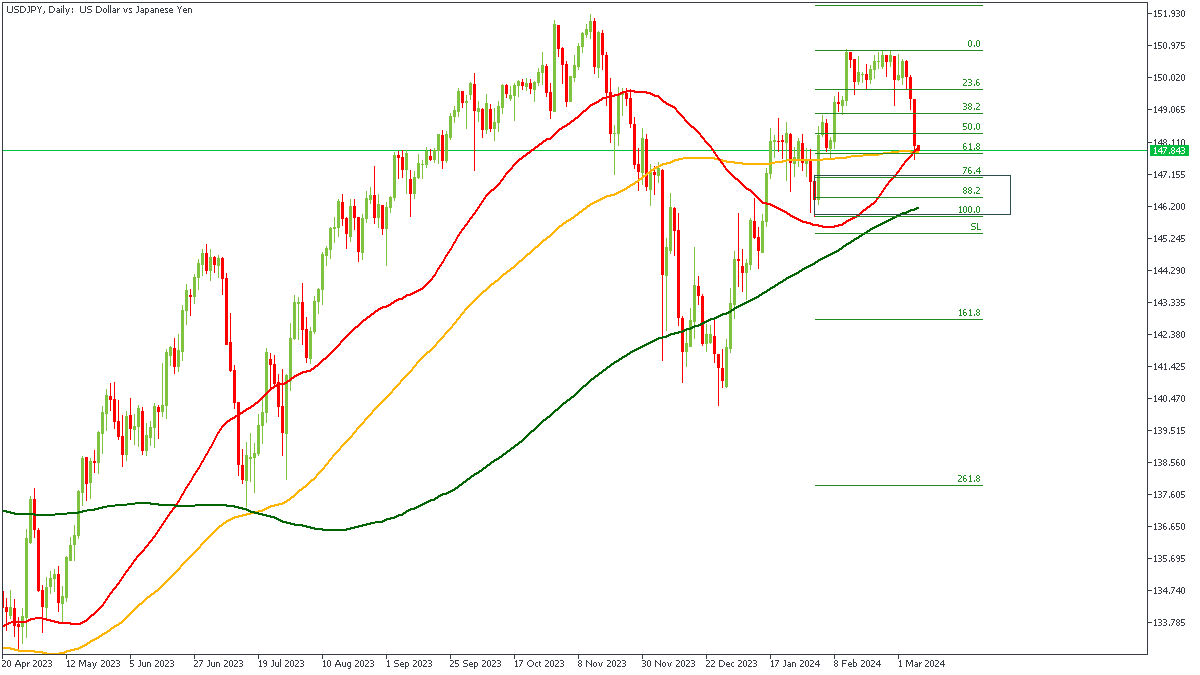

Here on the daily timeframe of USDJPY we clearly see the uptrend as indicated by the moving averages, with the 50 and 100 period moving averages providing ample support for the price action at the moment. Combining this with the bullish array of the moving averages and the Fibonacci retracement levels, I presume the market could regain bullish momentum in a short while - possibly as a result of the NFP data.

Analyst’s Expectations:

Direction: Bullish

Target: 149.718

Invalidation: 145.815

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

A estimativa para os números finais é que o PIB do quarto trimestre se mantenha na casa dos 3,2%, mostrando uma economia aquecida

As especulações de que as autoridades do BOJ irão intervir para conter qualquer fraqueza adicional do JPY mantêm um limite para quaisquer ganhos adicionais

Opiniões divergentes dos oradores do Fed sobre cortes de taxas prejudica o desempenho do USD

Depois da queda no mês de março em cerca de 26 mil vagas de emprego, a expectativa do mercado é de nova queda para 8,790M para o mês de fevereiro do mesmo ano

Nesta segunda-feira, primeiro dia do mês de abril, os EUA liberam os números dos PMIs da S&P Global e do ISM para a indústria

Todas as atenções estarão nos preços básicos do PCE (núcleo) dos EUA, que excluem alimentos e energia para o mês de março, com a expectativa de que os números venham abaixo do mês anterior, que registraram um aumento de 0,4%

A FBS mantém registros de seus dados para operar este site. Ao pressionar o botão “Aceitar“, você concorda com nossa Política de Privacidade.

Seu pedido foi aceito

Um gerente ligará para você em breve.

O próximo pedido de chamada para este número de telefone

estará disponível em

Se você tiver um problema urgente, por favor, fale conosco pelo

Chat ao vivo

Erro interno. Por favor, tente novamente mais tarde

Não perca seu tempo. Acompanhe o impacto das NFP no dólar dos EUA e ganhe dinheiro!